Question: need answer Refer to the previous problem except that the stand-alone sellina prices are The stall had an estimated cost of P4,000,000 with a margin

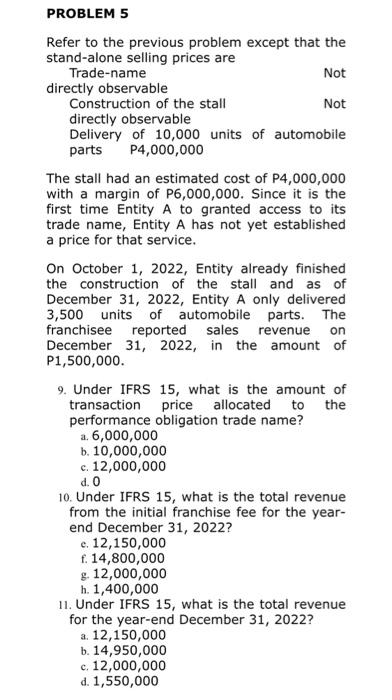

Refer to the previous problem except that the stand-alone sellina prices are The stall had an estimated cost of P4,000,000 with a margin of P6,000,000. Since it is the first time Entity A to granted access to its trade name, Entity A has not yet established a price for that service. On October 1, 2022, Entity already finished the construction of the stall and as of December 31, 2022, Entity A only delivered 3,500 units of automobile parts. The franchisee reported sales revenue on December 31, 2022, in the amount of P1,500,000. 9. Under IFRS 15, what is the amount of transaction price allocated to the performance obligation trade name? a. 6,000,000 b. 10,000,000 c. 12,000,000 d. 0 10. Under IFRS 15, what is the total revenue from the initial franchise fee for the yearend December 31, 2022? e. 12,150,000 f. 14,800,000 g. 12,000,000 h. 1,400,000 11. Under IFRS 15, what is the total revenue for the year-end December 31,2022 ? a. 12,150,000 b. 14,950,000 c. 12,000,000 d. 1,550,000 Refer to the previous problem except that the stand-alone sellina prices are The stall had an estimated cost of P4,000,000 with a margin of P6,000,000. Since it is the first time Entity A to granted access to its trade name, Entity A has not yet established a price for that service. On October 1, 2022, Entity already finished the construction of the stall and as of December 31, 2022, Entity A only delivered 3,500 units of automobile parts. The franchisee reported sales revenue on December 31, 2022, in the amount of P1,500,000. 9. Under IFRS 15, what is the amount of transaction price allocated to the performance obligation trade name? a. 6,000,000 b. 10,000,000 c. 12,000,000 d. 0 10. Under IFRS 15, what is the total revenue from the initial franchise fee for the yearend December 31, 2022? e. 12,150,000 f. 14,800,000 g. 12,000,000 h. 1,400,000 11. Under IFRS 15, what is the total revenue for the year-end December 31,2022 ? a. 12,150,000 b. 14,950,000 c. 12,000,000 d. 1,550,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts