Question: Need Answer to Part A Question 1 For $129,000 Blizzard, Inc. acquired 10% of PLAINS Co.'s outstanding common stock on January 1, 2014. At this

Need Answer to Part A

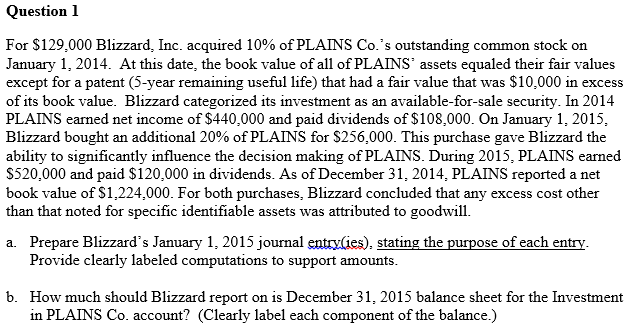

Question 1 For $129,000 Blizzard, Inc. acquired 10% of PLAINS Co.'s outstanding common stock on January 1, 2014. At this date, the book value of all of PLAINS assets equaled their fair values except for a patent (5-year remaining useful life) that had a fair value that was $10,000 in excess of its book value. Blizzard categorized its investment as an available-for-sale security. In 2014 PLAINS earned net income of $440,000 and paid dividends of $108,000. On January 1, 2015. Blizzard bought an additional 20% of PLAINS for S256,000. This purchase gave Blizzard the ability to significantly influence the decision making of PLAINS. During 2015 PLAINS earned S520,000 and paid $120,000 in dividends. As of December 31, 2014, PLAINS reported a net book value of $1,224,000. For both purchases, Blizzard concluded that any excess cost other than that noted for specific identifiable assets was attributed to goodwill a. Prepare Blizzard's January 1, 2015 journal entryGes), stating the purpose of each entry. Provide clearly labeled computations to support amounts b. How much should Blizzard report on is December 31, 2015 balance sheet for the Investment in PLAINS Co. account? (Clearly label each component of the balance.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts