Question: Need answer to Question 2 only Homework assignment week 1 Data US UK France Germany Japan Means: 0.1355 0.1589 0.1519 0.1435 0.1497 s.d.: 0.1535 0.2430

Need answer to Question 2 only

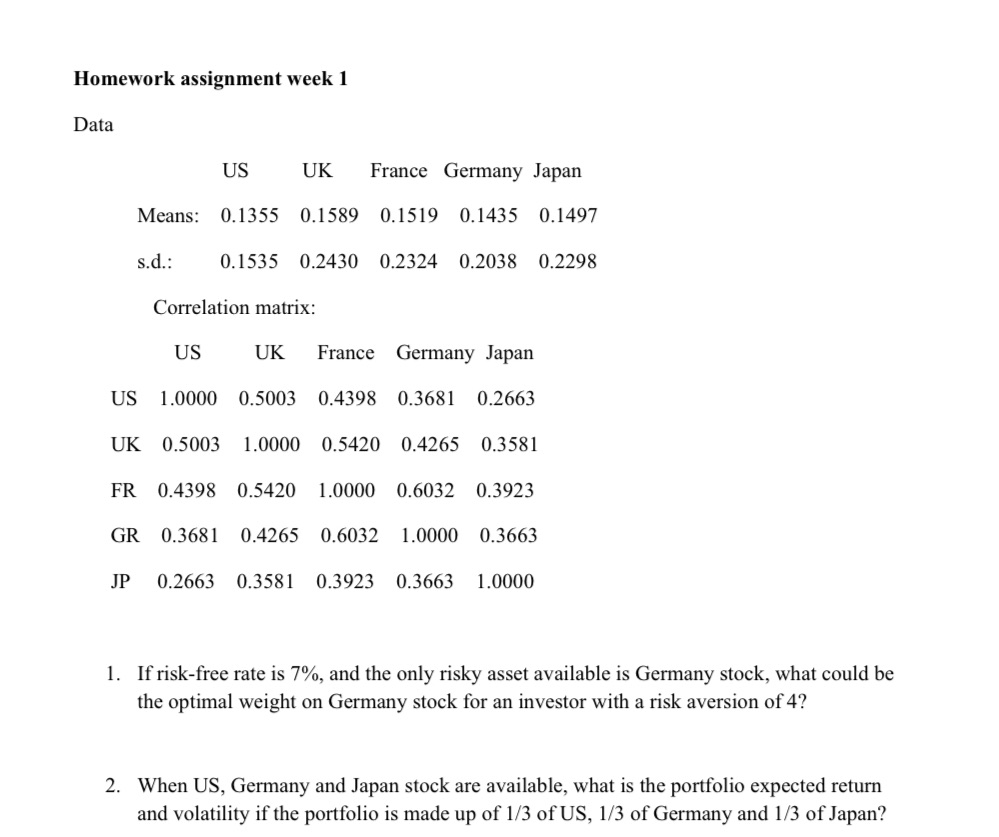

Homework assignment week 1 Data US UK France Germany Japan Means: 0.1355 0.1589 0.1519 0.1435 0.1497 s.d.: 0.1535 0.2430 0.2324 0.2038 0.2298 Correlation matrix: US UK France Germany Japan US 1.0000 0.5003 0.4398 0.3681 0.2663 UK 0.5003 1.0000 0.5420 0.4265 0.3581 FR 0.4398 0.5420 1.0000 0.6032 0.3923 GR 0.3681 0.4265 0.6032 1.0000 0.3663 JP 0.2663 0.3581 0.3923 0.3663 1.0000 1. If risk-free rate is 7%, and the only risky asset available is Germany stock, what could be the optimal weight on Germany stock for an investor with a risk aversion of 4? 2. When US, Germany and Japan stock are available, what is the portfolio expected return and volatility if the portfolio is made up of 1/3 of US, 1/3 of Germany and 1/3 of Japan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts