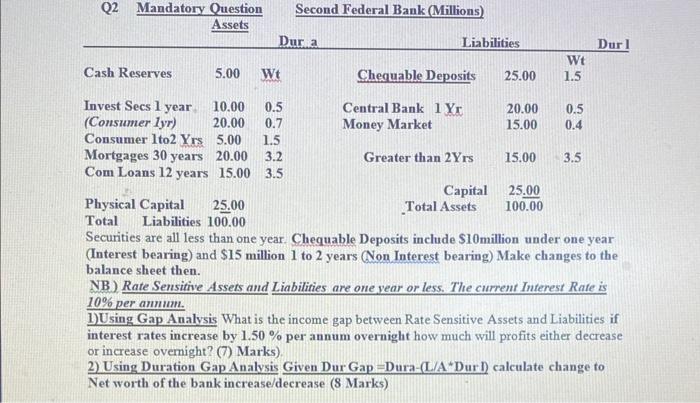

Question: need answer urgently Securities are all less than one year. Chequable Deposits include S10million under one year (Interest bearing) and $15 million 1 to 2

Securities are all less than one year. Chequable Deposits include S10million under one year (Interest bearing) and $15 million 1 to 2 years (Non Interest bearing) Make changes to the balance sheet then. NB), Rate Sensitive Assets and Liabilities are one year or less. The current Interest Rate is 10% per ammum. 1)Using Gap Analysis What is the income gap between Rate Sensitive Assets and Liabilities if interest rates increase by 1.50% per annum overnight how much will profits either decrease or increase ovemight? (7) Marks). 2) Using Duration Gap Analysis Given Dur Gap =Dura-(L/A*DurI) calculate change to Net worth of the bank increase/decrease (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts