Question: need answer with explanation QUESTION 9 10 points Save Ar 1 points) Suppose that you buy a 15-year 6% coupon bond today when the yield

need answer with explanation

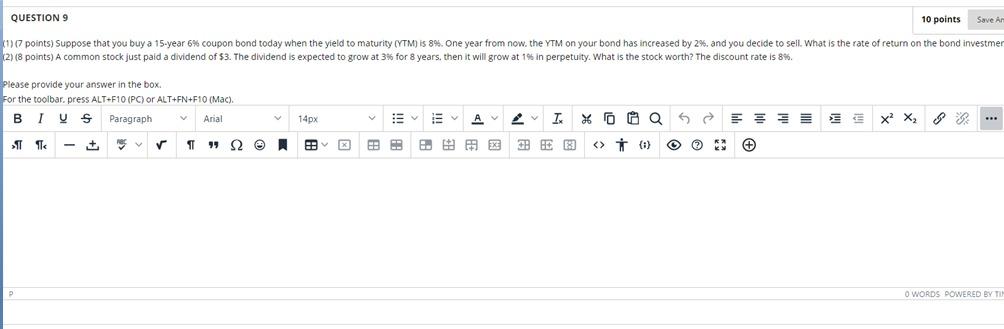

QUESTION 9 10 points Save Ar 1 points) Suppose that you buy a 15-year 6% coupon bond today when the yield to maturity (YTM) is 8%. One year from now. the YTM on your bond has increased by 2%. and you decide to sell. What is the rate of return on the bond investmer 2) (8 points) A common stock just paid a dividend of 53. The dividend is expected to grow at 3% for 8 years, then it will grow at 19 in perpetuity. What is the stock worth? The discount rate is 8%. please provide your answer in the box. For the toolbar.press ALT+F10 (PC) or ALT+FN+F10 (Mac). B TV Paragraph Arial 14px A TO 6 > E X2 X TIT 1 99 . X O WORDS POWERED BY TU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts