Question: Need answers for B, C, AND D. Example of their method shown below (NOT THE SAME NUMBERS). Wrong answers will be reported. Thank you!! Assume

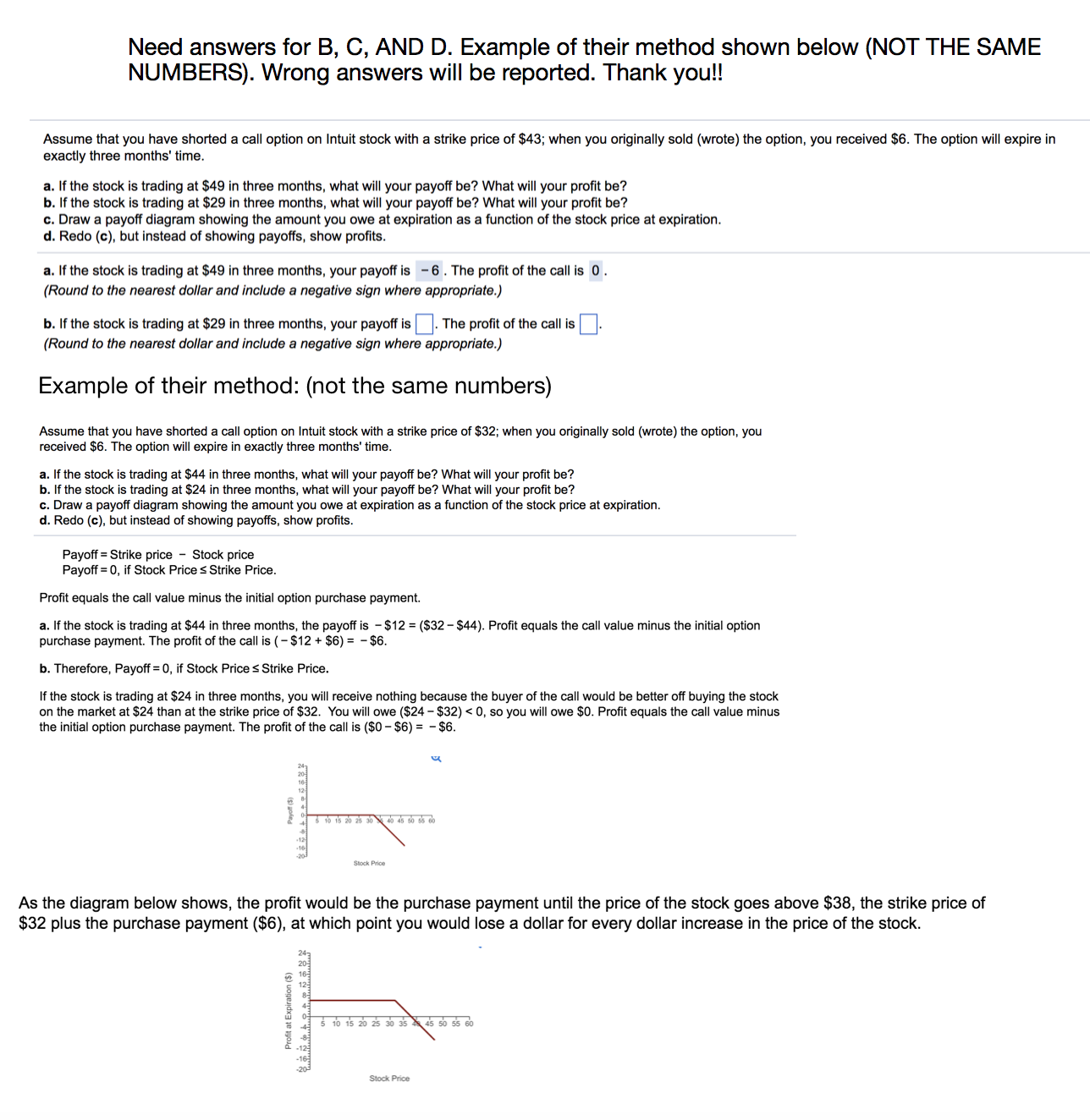

Need answers for B, C, AND D. Example of their method shown below (NOT THE SAME NUMBERS). Wrong answers will be reported. Thank you!! Assume that you have shorted a call option on Intuit stock with a strike price of $43; when you originally sold (wrote) the option, you received $6. The option will expire in exactly three months' time a. If the stock is trading at $49 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $29 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the amount you owe at expiration as a function of the stock price at expiration d. Redo (c), but instead of showing payoffs, show profits a. If the stock is trading at $49 in three months, your payoff is-6. The profit of the call is 0 (Round to the nearest dollar and include a negative sign where appropriate.) b. If the stock is trading at $29 in three months, your payoff isThe profit of the call is (Round to the nearest dollar and include a negative sign where appropriate.) Example of their method: (not the same numbers) Assume that you have shorted a call option on Intuit stock with a strike price of $32; when you originally sold (wrote) the option, you received $6. The option will expire in exactly three months' time a. If the stock is trading at $44 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $24 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the amount you owe at expiration as a function of the stock price at expiration d. Redo (c), but instead of showing payoffs, show profits Payoff Strike price - Stock price Payoff 0, if Stock Price s Strike Price Profit equals the call value minus the initial option purchase payment. a. If the stock is trading at $44 in three months, the payoff is-$12 = ($32-$44). Profit equals the call value minus the initial option purchase payment. The profit of the call is ( $12 $6)$6 b. Therefore, Payoff 0, if Stock Price Strike Price If the stock is trading at $24 in three months, you will receive nothing because the buyer of the call would be better off buying the stock on the market at $24 than at the strike price of $32. You will owe ($24- $32)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts