Question: NEED ANSWERS FOR B2 ASAP! Current Attempt in Progress Martinez Distribution markets CDs of numerous performing artists. At the beginning of March, Martinez had in

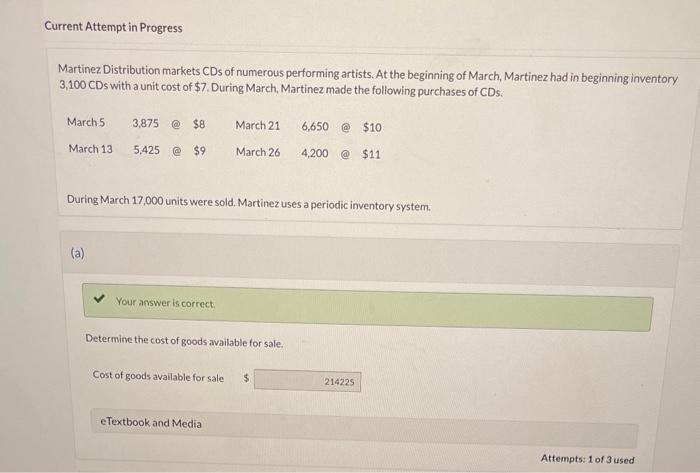

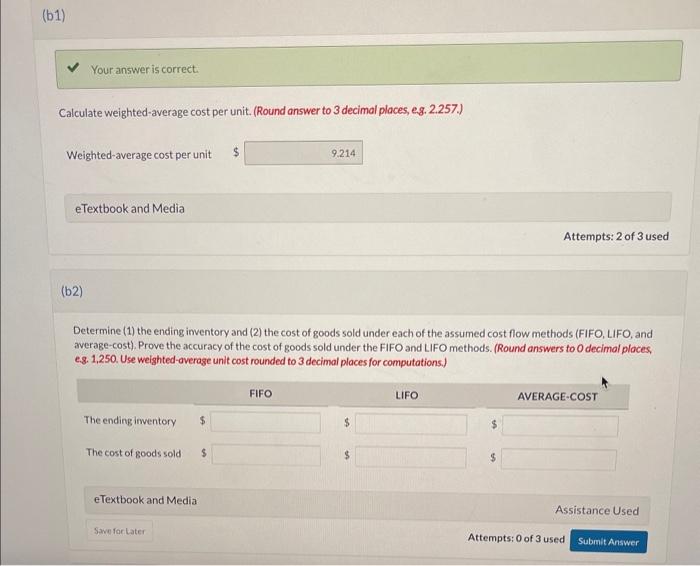

Current Attempt in Progress Martinez Distribution markets CDs of numerous performing artists. At the beginning of March, Martinez had in beginning inventory 3,100 CDs with a unit cost of \$7. During March, Martinez made the following purchases of CDs. During March 17,000 units were sold. Martinez uses a periodic inventory system. (a) Determine the cost of goods available for sale. Cost of goods available for sale \$ Calculate weighted-average cost per unit. (Round answer to 3 decimal places, eg. 2.257.) Weighted-average cost per unit eTextbook and Media Attempts: 2 of 3 use (b) Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. (Round answers to O decimal ploces, e.8. 1,250. Use weighted-overage unit cost rounded to 3 decimal places for computations.) Current Attempt in Progress Martinez Distribution markets CDs of numerous performing artists. At the beginning of March, Martinez had in beginning inventory 3,100 CDs with a unit cost of \$7. During March, Martinez made the following purchases of CDs. During March 17,000 units were sold. Martinez uses a periodic inventory system. (a) Determine the cost of goods available for sale. Cost of goods available for sale \$ Calculate weighted-average cost per unit. (Round answer to 3 decimal places, eg. 2.257.) Weighted-average cost per unit eTextbook and Media Attempts: 2 of 3 use (b) Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. (Round answers to O decimal ploces, e.8. 1,250. Use weighted-overage unit cost rounded to 3 decimal places for computations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts