Question: NEED ASAP Consider an asset that had the historical average annual return of 7.20% and the standard deviation of returns of 12.30%. Assume the returns

NEED ASAP

NEED ASAP

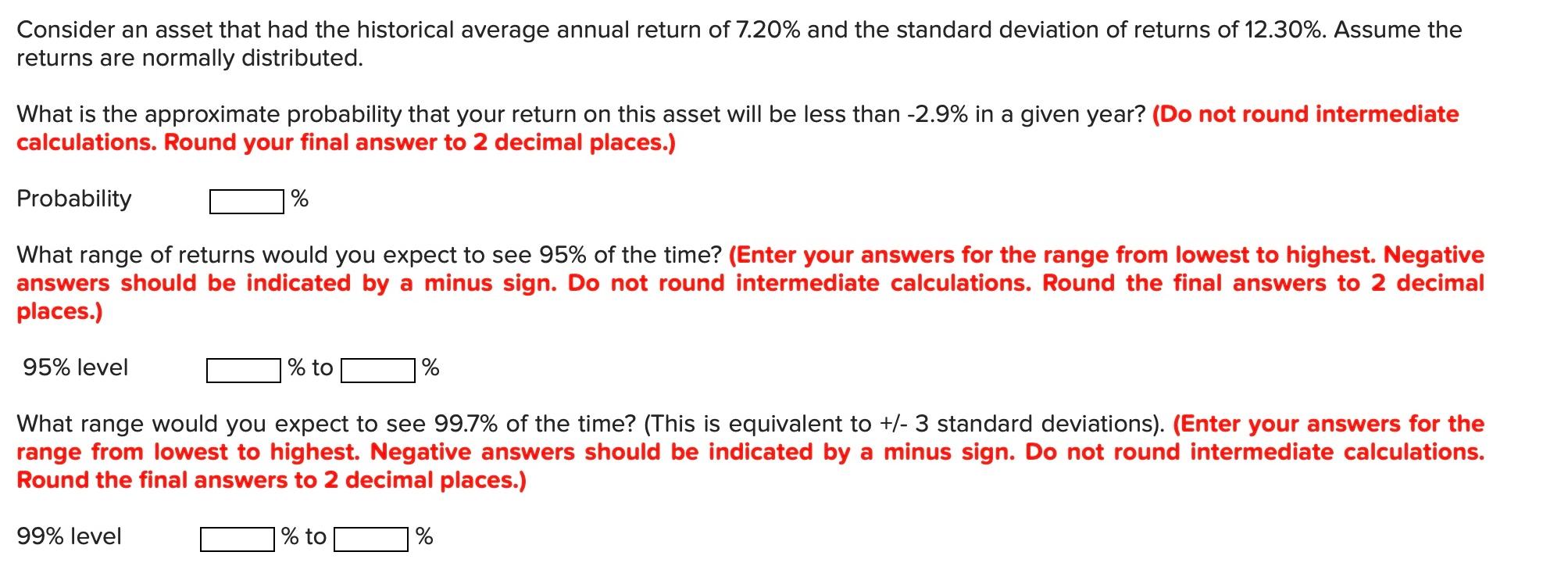

Consider an asset that had the historical average annual return of 7.20% and the standard deviation of returns of 12.30%. Assume the returns are normally distributed. What is the approximate probability that your return on this asset will be less than -2.9% in a given year? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Probability % What range of returns would you expect to see 95% of the time? (Enter your answers for the range from lowest to highest. Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round the final answers to 2 decimal places.) 95% level % to % What range would you expect to see 99.7% of the time? (This is equivalent to +/- 3 standard deviations). (Enter your answers for the range from lowest to highest. Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round the final answers to 2 decimal places.) 99% level % to %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts