Question: need asap Problem 1. The textbook and lecture notes say that items listed below are conditions for the Modigliani-Miller Theorem 1 (MM1 = Irrelevance of

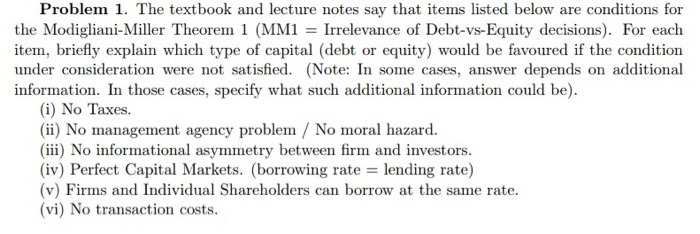

Problem 1. The textbook and lecture notes say that items listed below are conditions for the Modigliani-Miller Theorem 1 (MM1 = Irrelevance of Debt-vs-Equity decisions). For each item, briefly explain which type of capital (debt or equity) would be favoured if the condition under consideration were not satisfied. (Note: In some cases, answer depends on additional information. In those cases, specify what such additional information could be). (i) No Taxes. (ii) No management agency problem / No moral hazard. (iii) No informational asymmetry between firm and investors. (iv) Perfect Capital Markets. (borrowing rate = lending rate) (v) Firms and Individual Shareholders can borrow at the same rate. (vi) No transaction costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts