Question: need asap write clear The process for producing a fruit-tree pesticide has a first cost of $200,000 (initial investment at year 0) with annual operating

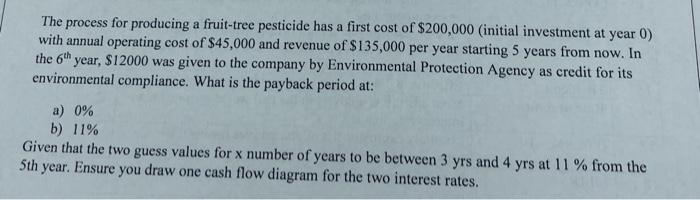

The process for producing a fruit-tree pesticide has a first cost of $200,000 (initial investment at year 0) with annual operating cost of $45,000 and revenue of $135,000 per year starting 5 years from now. In the 6th year, $12000 was given to the company by Environmental Protection Agency as credit for its environmental compliance. What is the payback period at: a) 0% b) 11% Given that the two guess values for x number of years to be between 3 yrs and 4 yrs at 11 % from the 5th year. Ensure you draw one cash flow diagram for the two interest rates. The process for producing a fruit-tree pesticide has a first cost of $200,000 (initial investment at year 0) with annual operating cost of $45,000 and revenue of $135,000 per year starting 5 years from now. In the 6th year, $12000 was given to the company by Environmental Protection Agency as credit for its environmental compliance. What is the payback period at: a) 0% b) 11% Given that the two guess values for x number of years to be between 3 yrs and 4 yrs at 11 % from the 5th year. Ensure you draw one cash flow diagram for the two interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts