Question: Need assistance Form 1065 schedule k-1. Attached to get data for K-1. Jamco Turf Income Statement for the Year Ended December 31, 2023 Salei 4,

Need assistance Form 1065 schedule k-1. Attached to get data for K-1.

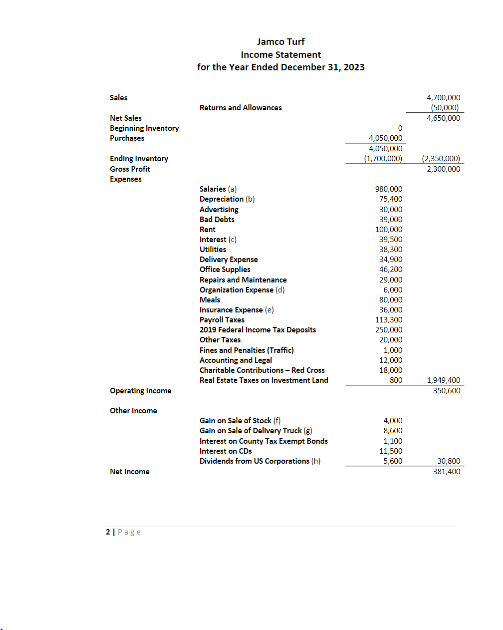

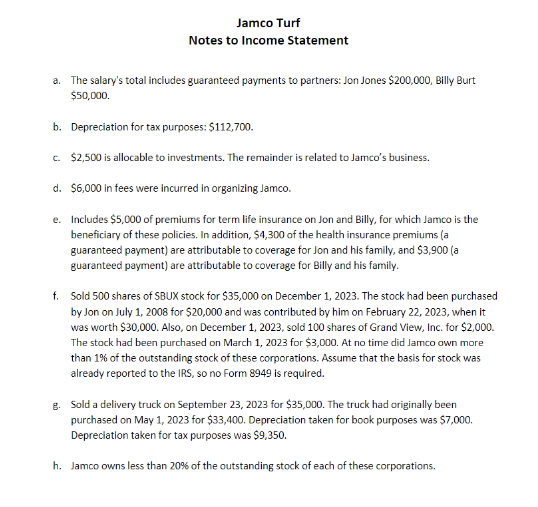

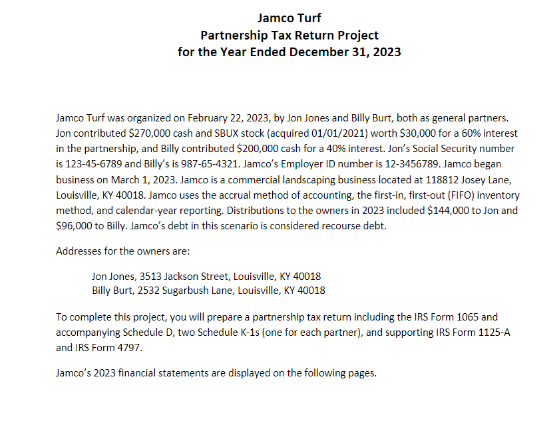

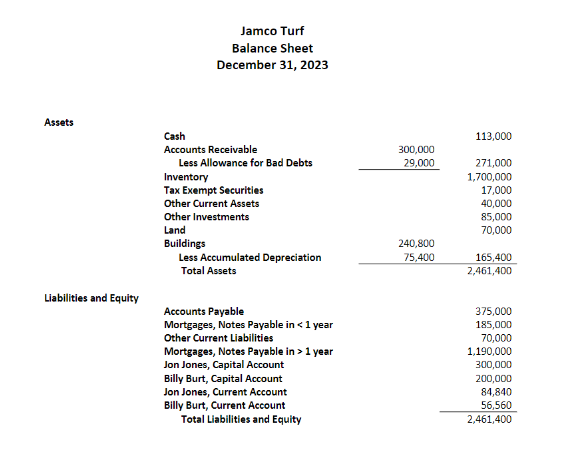

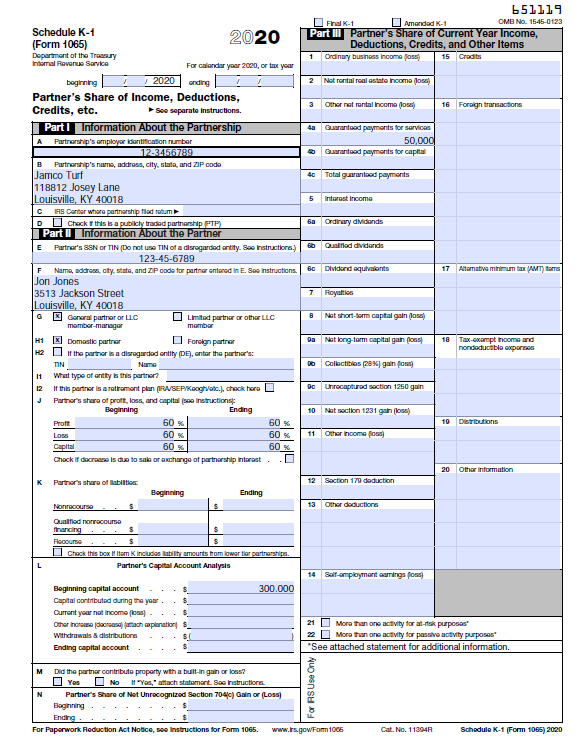

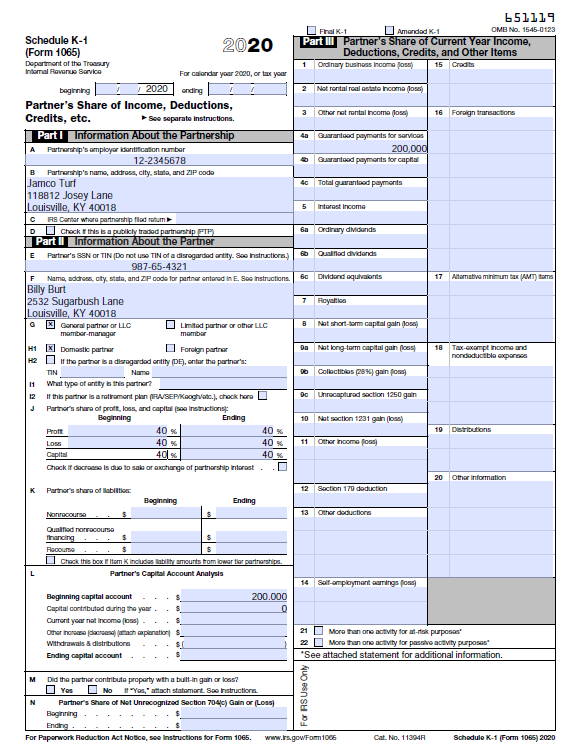

Jamco Turf Income Statement for the Year Ended December 31, 2023 Salei 4, ANNDOC Returna and Allowances Net Sales 1,650,000 Beginning Inventory Purchases 1,050,000 Ending Inventory (2 350.000) Gross Profit 2.300,000 Expenses Salaries (al 980,000 Depreciation [b) 75,400 Advertising 20,000 Bad Debts 39,000 Rent 106,000 Interest (c) 29,500 Utilities 38,300 Delivery Expense 34,901 Office Supplies 46,201 Repairs and Maintenance 29,003 Organization Experne [d) 80.007 Insurance Expense (e) 36007 Payroll Taxes 113,300 2019 Federal Income Tax Deposits 250,001 Other Taxes 202001 Fines and Penalties (Traffic) 1,000 Accounting and Legal 12,000 Charitable Contributions - Red Cross 16,000 Real Estate Taxes on Investment Land 800 1,949,100 Operating Income Other Income Galin on sale of stock (f] Galin on Sale of Delivery Truck [g) Interest on County Tax Exempt Bonds 1,100 Interest on CDs 11,500 Dividends from US Corporations [h) 5,600 30,800 Not Income 381,40 2|Page\fJamco Turf Partnership Tax Return Project for the Year Ended December 31, 2023 Jamco Turf was organized on February 22, 2023, by Jon Jones and Billy Burt, both as general partners. Jon contributed $270,000 cash and SBUX stock (acquired 01/01/2021) worth $30,000 for a 60% interest in the partnership, and Billy contributed $200,000 cash for a 40%% interest. Jon's Social Security number is 123-45-6789 and Billy's is 987-65-4321. Jamco's Employer ID number is 12-3456789. Jamco began business on March 1, 2023. Jamco is a commercial landscaping business located at 118812 Josey Lane, Louisville, KY 40018. Jamco uses the accrual method of accounting, the first-In, first-out (FIFO) Inventory method, and calendar-year reporting. Distributions to the owners in 2023 included $144,000 to Jon and $96,000 to Billy. Jamco's debt in this scenario is considered recourse debt. Addresses for the owners are: Jon Jones, 3513 Jackson Street, Louisville, KY 40018 Billy Burt, 2532 Sugarbush Lane, Louisville, KY 40018 To complete this project, you will prepare a partnership tax return including the IRS Form 1065 and accompanying Schedule D. two Schedule K-1s (one for each partner), and supporting IRS Form 1125-A and IRS Form 4797. Jamoo's 2023 financial statements are displayed on the following pages.Jamco Turf Balance Sheet December 31, 2023 Assets Cash 113,000 Accounts Receivable 300,000 Less Allowance for Bad Debts 29,000 271,000 Inventory 1,700,000 Tax Exempt Securities 17,000 Other Current Assets 40,000 Other Investments 85,000 Land 70,000 Buildings 240,800 Less Accumulated Depreciation 75,400 165,400 Total Assets 2,461,400 Liabilities and Equity Accounts Payable 375,000 Mortgages, Notes Payable in 1 year 1,190,000 Jon Jones, Capital Account 300,000 Billy Burt, Capital Account 200,000 Jon Jones, Current Account 84,840 Billy Burt, Current Account 56,560 Total Liabilities and Equity 2,461,400\f651119 Fral K-1 Amandad K-1 OMB No. 1545-0123 Schedule K-1 2020 Part Ill Partner's Share of Current Year Income, (Form 1065) Deductions, Credits, and Other Items Department of the Treasury |Ordinary business Inooma poss) 15 Credits Internal Ravanua Service For colander your 2020, or tax your beginning 2020 anding Not rental real estate Income (loss] Partner's Share of Income, Deductions, 3 Other not rental Income (loss) 16 Foreign transactions Credits, etc. Soo separate Instructions. Part I Information About the Partnership |Guaranteed payments for services A Partnership's employer Identification number 200.000 12-2345678 Guaranteed payments for capital 8 Partnership's name, address, city, state, and ZIP code Jamco Turf Total guaranteed payments 118812 Josey Lane Louisville, KY 40018 Interest Income C FS Canter wh where partnership filed rotum D Chock W this Is a publicly traded partnership (PIP) Ba Ordinary dividends Part II Information About the Partner E Partner's SEN or TIN (Do not use TIN of a disregarded entity. Soo Instructions.) Qualified dividends 987-65-4321 F Name, address, city, state, and ZIP code for partner entered In E. Boe Instructions.| 17 Alternative minimum tax (AM) Homes Billy Burt 2532 Sugarbush Lane Louisville, KY 40018 X General partner or LLC Limited partner or other LLC B Not short-form capital gain Joss) member-manager member * Domestic partner Foreign partner Do Not long-for capital gain (039)] 18 Tax-exempt Income and nondeductible expenses H2 If the partner is a disregarded entity (DE), ontor the partner's: TIN Name Collectibles (8 16] gain foss) 11 What type of onility la this partner? 12 If this partner Is a rollcoment plan (IRA/SEP/keogh/etc.], chock here_ Do Unrecaptured section 1250 gain J Partner's share of profit, loss, and capital joon Instructionsy: Beginning Ending 10 Not section 1231 gain (loss) Profit 40 % 40 % 19 Distributions Loss 40 % 40 % 11 Other Income poss) Capital 40 % Check If decrease Is due to sale or exchange of partnership Interest 20 Other Information K Partner's share of liabilities 12 Baction 171 deduction Beginning Ending Nonmooursa 13 Other deductions Qualified nonrecourse financing Flocourse Chack this box If Hem K Includes ability amounts from lower Partner's Capital Account Analysis 14 8alf-employment earnings foss) Beginning capital account 200.000 Capital contributed during the your . Current your not Income (loss]. Other Increase [decrease) jaffach explanation) _ 21 More than one activity for al-risk purposes" Withdrawals & distributiones 22 More than one activity for passive activity purposes" Ending capital account See attached statement for additional information M Did the partner contribute property with a built-in gain or loss? Yes No I "Yas, " attach statement. Boo Instructions. For AS Use Only IN Partner's Share of Not Unrecognized Section 704/c) Gain or (Loss) Bloginning Ending for Paperwork Reduction Act Nobco, 239 Instructions for Form 1065. www.Fa.gowFonn1006 Cut. No. 113048 Schodule K-1 (Form 1085) 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts