Question: Need assistance on this assignment. contribute to the assignment compilation through processes including ideation, research, analyses, and critical thinking applications. In addition, please obtain relevant

Need assistance on this assignment.

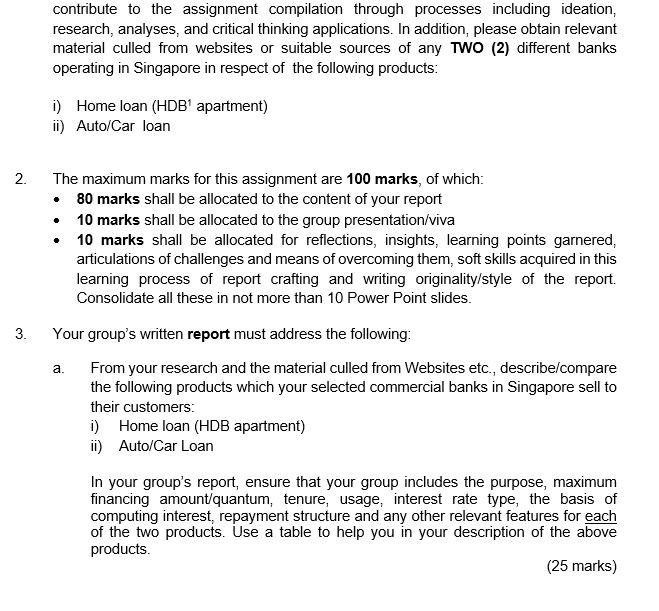

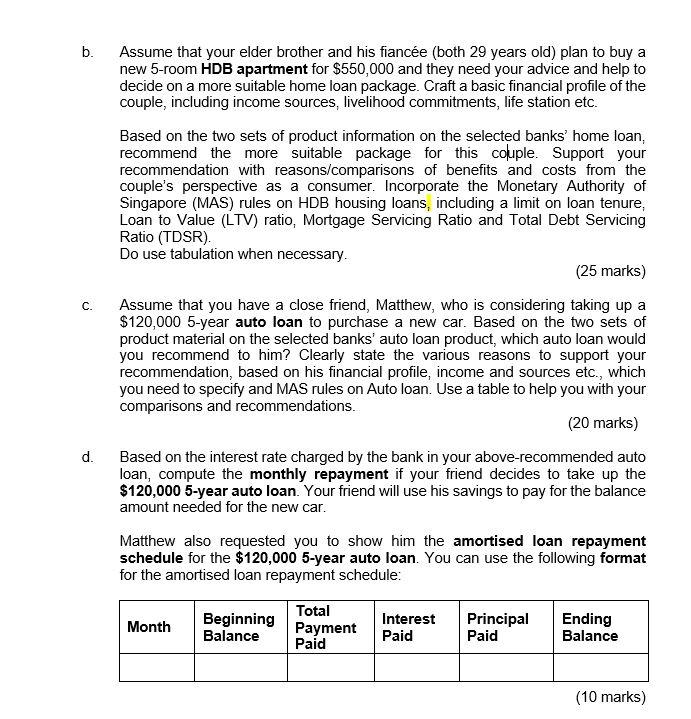

contribute to the assignment compilation through processes including ideation, research, analyses, and critical thinking applications. In addition, please obtain relevant material culled from websites or suitable sources of any TWO (2) different banks operating in Singapore in respect of the following products: i) Home loan (HDB apartment) ii) Auto/Car loan 2. The maximum marks for this assignment are 100 marks, of which: - 80 marks shall be allocated to the content of your report - 10 marks shall be allocated to the group presentation/viva - 10 marks shall be allocated for reflections, insights, learning points garnered, articulations of challenges and means of overcoming them, soft skills acquired in this learning process of report crafting and writing originality/style of the report. Consolidate all these in not more than 10 Power Point slides. 3. Your group's written report must address the following: a. From your research and the material culled from Websites etc., describe/compare the following products which your selected commercial banks in Singapore sell to their customers: i) Home loan (HDB apartment) ii) Auto/Car Loan In your group's report, ensure that your group includes the purpose, maximum financing amount/quantum, tenure, usage, interest rate type, the basis of computing interest, repayment structure and any other relevant features for each of the two products. Use a table to help you in your description of the above products. (25 marks) b. Assume that your elder brother and his fiance (both 29 years old) plan to buy a new 5-room HDB apartment for $550,000 and they need your advice and help to decide on a more suitable home loan package. Craft a basic financial profile of the couple, including income sources, livelihood commitments, life station etc. Based on the two sets of product information on the selected banks' home loan, recommend the more suitable package for this coluple. Support your recommendation with reasons/comparisons of benefits and costs from the couple's perspective as a consumer. Incorporate the Monetary Authority of Singapore (MAS) rules on HDB housing loans, including a limit on loan tenure, Loan to Value (LTV) ratio, Mortgage Servicing Ratio and Total Debt Servicing Ratio (TDSR). Do use tabulation when necessary. (25 marks) c. Assume that you have a close friend, Matthew, who is considering taking up a $120,000 5-year auto loan to purchase a new car. Based on the two sets of product material on the selected banks' auto loan product, which auto loan would you recommend to him? Clearly state the various reasons to support your recommendation, based on his financial profile, income and sources etc., which you need to specify and MAS rules on Auto loan. Use a table to help you with your comparisons and recommendations. (20 marks) d. Based on the interest rate charged by the bank in your above-recommended auto loan, compute the monthly repayment if your friend decides to take up the $120,000 5-year auto loan. Your friend will use his savings to pay for the balance amount needed for the new car. Matthew also requested you to show him the amortised loan repayment schedule for the $120,000 5-year auto loan. You can use the following format for the amortised loan repayment schedule: (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts