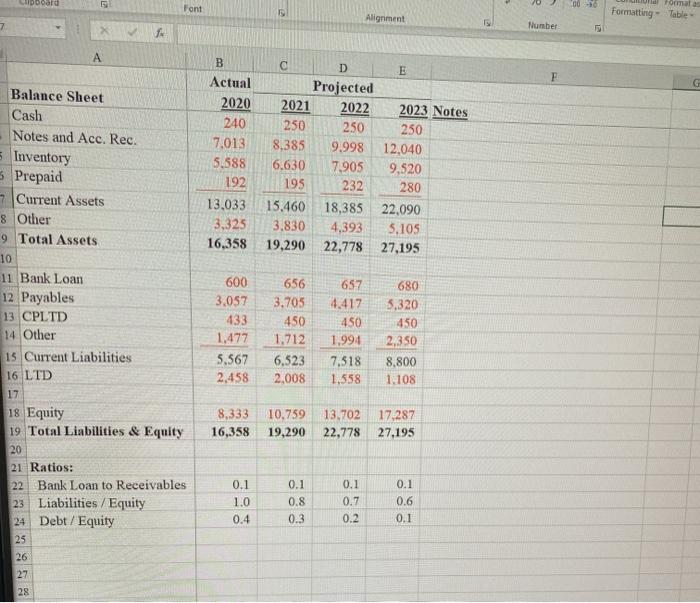

Question: need assistance with the formulas for the excel sheet. Dooard Font 00 Formal Alignment Formatting Table 7 Number f A F G B Actual 2020

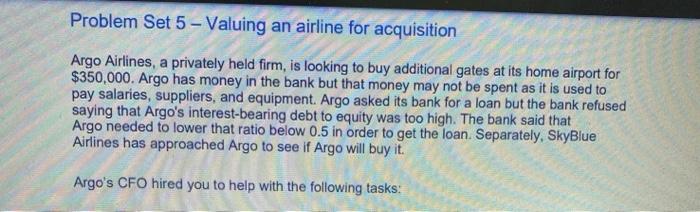

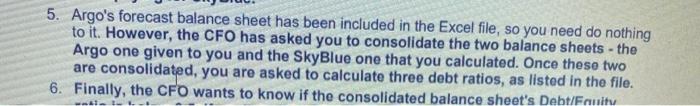

Dooard Font 00 Formal Alignment Formatting Table 7 Number f A F G B Actual 2020 240 7.013 5.588 192 13.033 3,325 16,358 D E Projected 2021 2022 2023 Notes 250 250 250 8,385 9.998 12.040 6.630 7.905 9,520 195 232 280 15.460 18,385 22.090 3.830 4,393 5.105 19,290 22,778 27,195 Balance Sheet Cash Notes and Acc. Rec. Inventory Prepaid 7 Current Assets 8 Other 9 Total Assets 10 11 Bank Loan 12 Payables 13 CPLTD 14 Other 15 Current Liabilities 16 LTD 17 18 Equity 19 Total Liabilities & Equity 20 21 Ratios: 22 Bank Loan to Receivables 23 Liabilities / Equity 24 Debt / Equity 25 600 3.057 433 1,477 5,567 2.458 656 3.705 450 1.712 6.523 2,008 657 4.417 450 1,994 7.518 1.558 680 3.320 450 2,350 8.800 1.108 8,333 10,759 13,702 17.287 19,290 22,778 27.195 16,358 0.1 1.0 0.4 0.1 0.8 0.3 0.1 0.7 0.2 0.1 0.6 0.1 26 27 28 Problem Set 5 - Valuing an airline for acquisition Argo Airlines, a privately held firm, is looking to buy additional gates at its home airport for $350,000. Argo has money in the bank but that money may not be spent as it is used to pay salaries, suppliers, and equipment. Argo asked its bank for a loan but the bank refused saying that Argo's interest-bearing debt to equity was too high. The bank said that Argo needed to lower that ratio below 0.5 in order to get the loan Separately, SkyBlue Airlines has approached Argo to see if Argo will buy it. Argo's CFO hired you to help with the following tasks: 5. Argo's forecast balance sheet has been included in the Excel file, so you need do nothing to it. However, the CFO has asked you to consolidate the two balance sheets - the Argo one given to you and the SkyBlue one that you calculated. Once these two are consolidated, you are asked to calculate three debt ratios, as listed in the file. 6. Finally, the CFO wants to know if the consolidated balance sheet's Debt/Fauit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts