Question: NEED B , C , AND D PLEASE!!! mathxl.com Netflix My.UTEP UTEP Single Sign On Application Portal Content Do Homework - mariane fuentes + Business

NEED B , C , AND D PLEASE!!!

NEED B , C , AND D PLEASE!!!

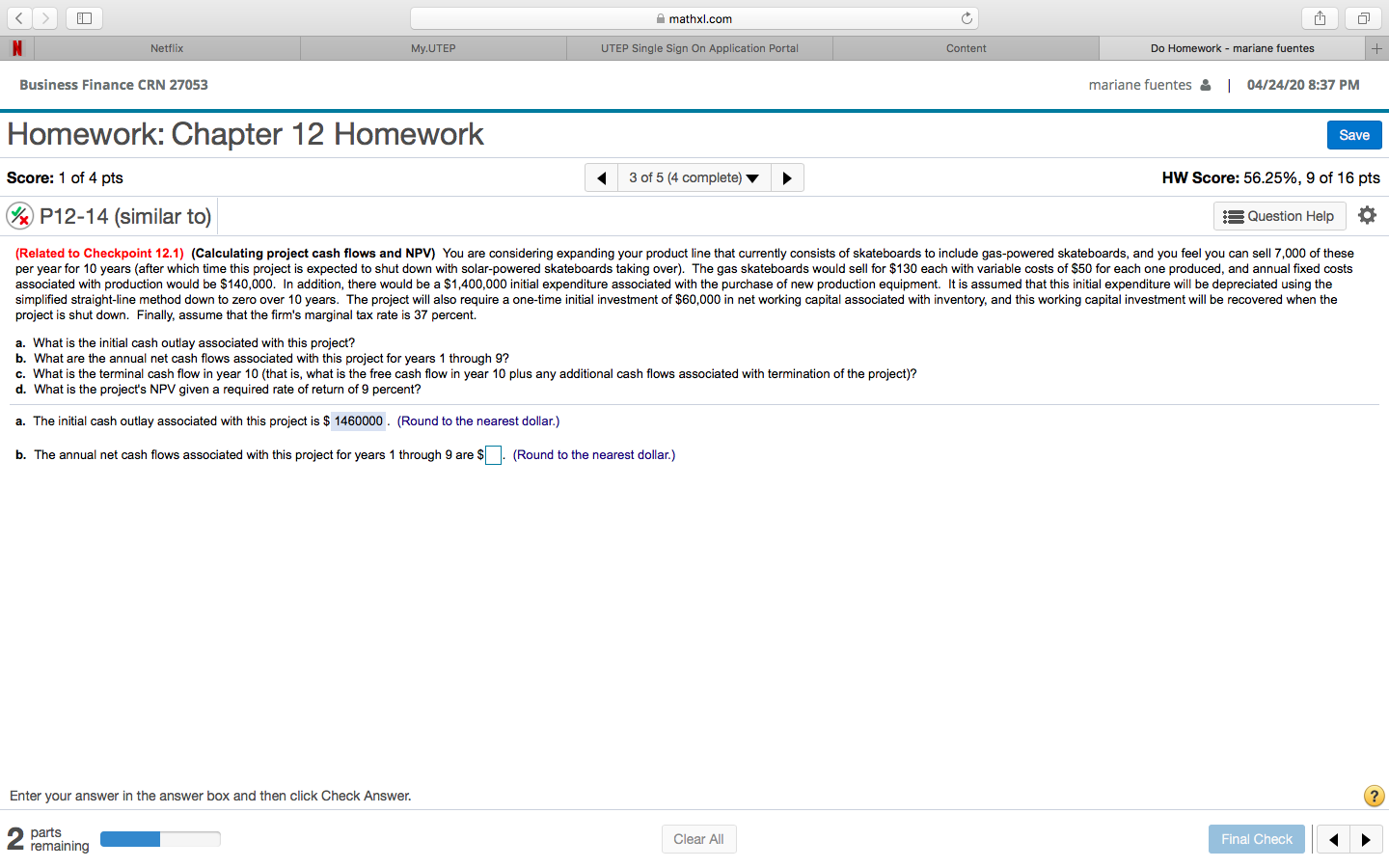

mathxl.com Netflix My.UTEP UTEP Single Sign On Application Portal Content Do Homework - mariane fuentes + Business Finance CRN 27053 mariane fuentes : | 04/24/20 8:37 PM Homework: Chapter 12 Homework Save Score: 1 of 4 pts 3 of 5 (4 complete) HW Score: 56.25%, 9 of 16 pts % P12-14 (similar to) Question Help (Related to Checkpoint 12.1) (Calculating project cash flows and NPV) You are considering expanding your product line that currently consists of skateboards to include gas-powered skateboards, and you feel you can sell 7,000 of these per year for 10 years (after which time this project is expected to shut down with solar-powered skateboards taking over). The gas skateboards would sell for $130 each with variable costs of $50 for each one produced, and annual fixed costs associated with production would be $140,000. In addition, there would be a $1,400,000 initial expenditure associated with the purchase of new production equipment. It is assumed that this initial expenditure will be depreciated using the simplified straight-line method down to zero over 10 years. The project will also require a one-time initial investment of $60,000 in net working capital associated with inventory, and this working capital investment will be recovered when the project is shut down. Finally, assume that the firm's marginal tax rate is 37 percent. a. What is the initial cash outlay associated with this project? b. What are the annual net cash flows associated with this project for years 1 through 9? c. What is the terminal cash flow in year 10 (that is, what is the free cash flow in year 10 plus any additional cash flows associated with termination of the project)? d. What is the project's NPV given a required rate of return of 9 percent? a. The initial cash outlay associated with this project is $ 1460000. (Round to the nearest dollar.) b. The annual net cash flows associated with this project for years 1 through 9 are $ (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. parts 2 remaining Clear All Final Check Rusiness Finance CRN 27053 Homework: Chapter 12 Homework Score: 1 of 4 pts P12-14 (similar to) HW Score: 56.25%, 9 of 16 pts Question Help Related to Checkpo i nt s and NPV) V endringending your produselor coro board nude gas powered boards, and you feel you can sel 7000 of these per year for 10 years were there wh e n the borde wor th the cows of $50 for each one produced, and feed costs red with production would be $140.000 hation, there would be a $1.400.000 pe r the purchase of new production and med at the expenditure will be depreciate the simplified s ine method down to over 10 years. There will ne v ement of 100.000 worting t o try and wrong investment accred when the project is shutdow. Finally, w e are wa marginal box 37 percent What is the cash out w ird? What the c o st What is the cow what the tow n of the project What is the project's NPV ginag r otum of percent? The initial cash outy d with $5460000 (Round to the nearest dollar) Enter your answer in the box and track Check Answer 2 orang MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts