Question: need both solution as soon as possible plz Suppose analysts anticipate Baruch Corporation to pay 1 dollar per share next year (1.0. Year 1). Analysts

need both solution as soon as possible plz

need both solution as soon as possible plz

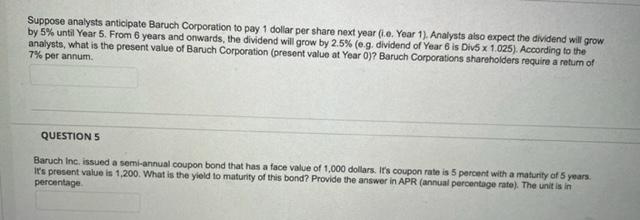

Suppose analysts anticipate Baruch Corporation to pay 1 dollar per share next year (1.0. Year 1). Analysts also expect the dividend will grow by 5% until Year 5. From 6 years and onwards, the dividend will grow by 2.5% (eg. dividend of Year 6 is Div5 x 1025). According to the analysts, what is the present value of Baruch Corporation (present value at Year 0)? Baruch Corporations shareholders require a return of 7% per annum QUESTION 5 Baruch Inc, issued a semi-annual coupon bond that has a face value of 1,000 dollars. It's coupon rate is 5 percent with a maturity of 5 years it's present value is 1,200. What is the yield to maturity of this bond? Provide the answer in APR (annual percentage rate). The unit is in percentage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts