Question: NEED CORRECT ANSWER ASAP!!! plz explain where i weng wrong! thank you!!! Determining Bad Debt Expense Using the Aging Method At the beginning of the

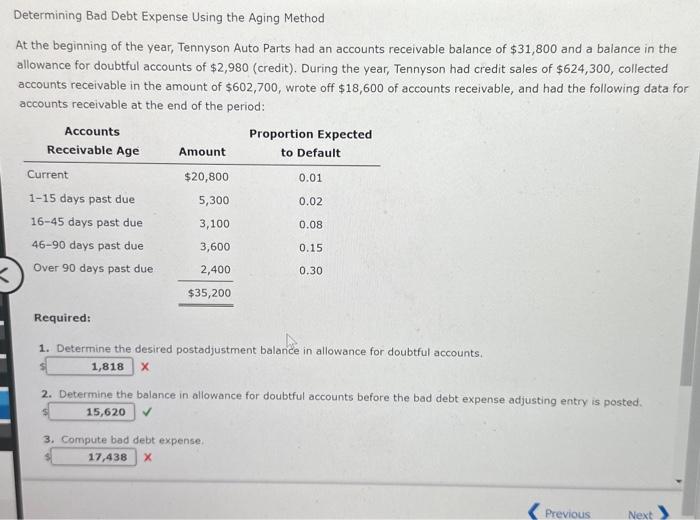

Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto Parts had an accounts receivable balance of $31,800 and a balance in the allowance for doubtful accounts of $2,980 (credit). During the year, Tennyson had credit sales of $624,300, collected accounts receivable in the amount of $602,700, wrote off $18,600 of accounts receivable, and had the following data for accounts receivable at the end of the period: 1. Determine the desired postadjustment balance in allowance for doubtful accounts. x 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 3. Compute bad debt expense. x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts