Question: Need Correct answer Only Please . 76. Break Even Maturity Spot Rate RTP A German firm buys a Call on $ 10,00,000 with a strike

Need Correct answer Only Please .

Need Correct answer Only Please .

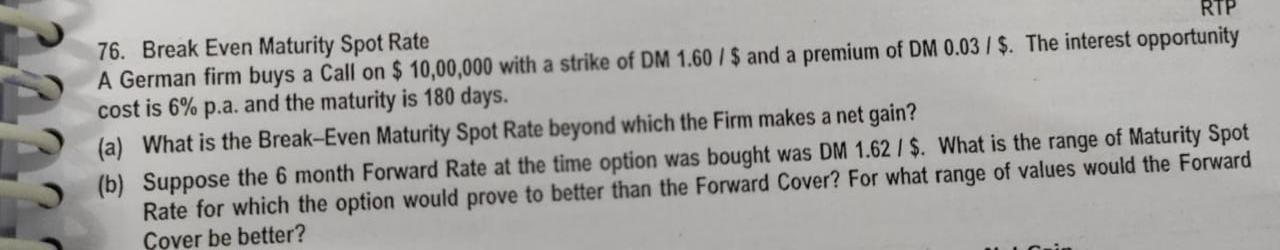

76. Break Even Maturity Spot Rate RTP A German firm buys a Call on $ 10,00,000 with a strike of DM 1.60 / $ and a premium of DM 0.03 / $. The interest opportunity cost is 6% p.a. and the maturity is 180 days. (a) What is the Break-Even Maturity Spot Rate beyond which the Firm makes a net gain? (b) Suppose the 6 month Forward Rate at the time option was bought was DM 1.62 / $. What is the range of Maturity Spot Rate for which the option would prove to better than the Forward Cover? For what range of values would the Forward Cover be better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts