Question: need correct answer WRT, a calendar year S corporation, has 100 shares of outstanding stock. At the beginning of the year, Mr. Wallace owned all

need correct answer

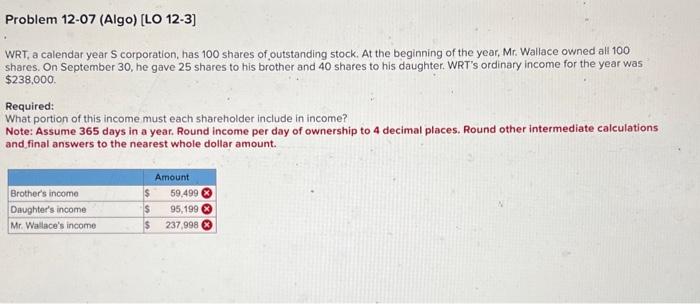

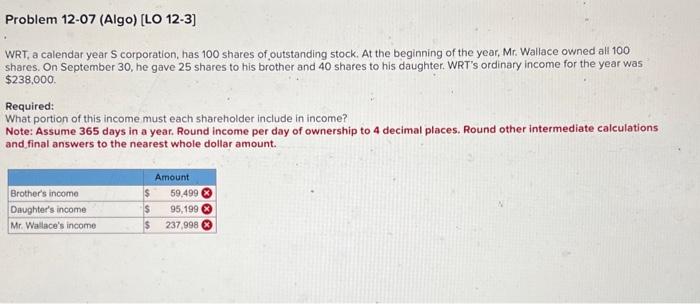

WRT, a calendar year S corporation, has 100 shares of outstanding stock. At the beginning of the year, Mr. Wallace owned all 100 shares. On September 30 , he gave 25 shares to his brother and 40 shares to his daughter. WRT's ordinary income for the year was $238,000. Required: What portion of this income must each shareholder include in income? Note: Assume 365 days in a year. Round income per day of ownership to 4 decimal places. Round other intermediate calculations and final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock