Question: NEED CORRECT SOLUTION IN 10 MINS OR GET MULTIPLE DISLIKES Mr. Ram is holding the following securities: Particulars of Securities Cost ) Dividends Market Price

NEED CORRECT SOLUTION IN 10 MINS OR GET MULTIPLE DISLIKES

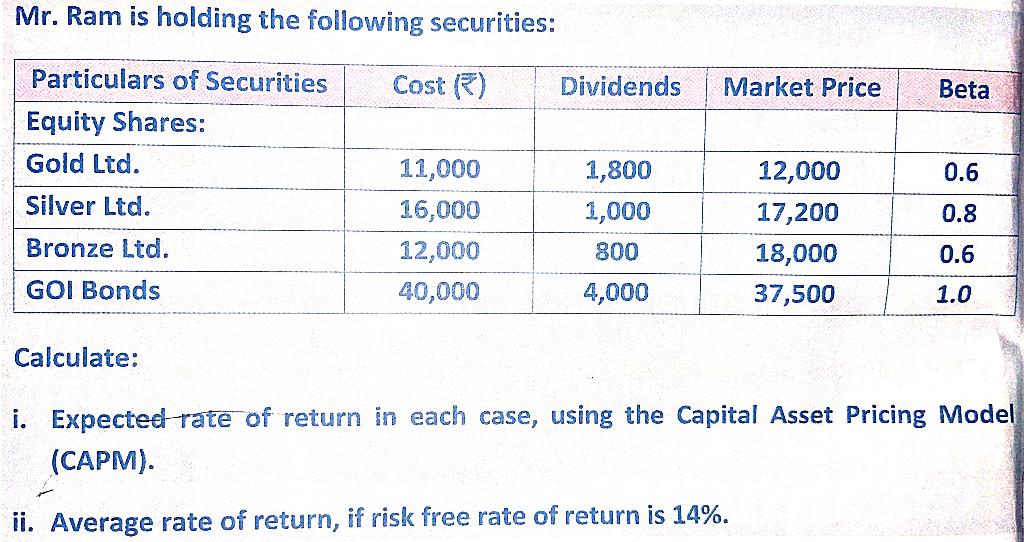

Mr. Ram is holding the following securities: Particulars of Securities Cost ) Dividends Market Price Beta Equity Shares: Gold Ltd. 0.6 Silver Ltd. 11,000 16,000 12,000 40,000 1,800 1,000 800 0.8 12,000 17,200 18,000 37,500 Bronze Ltd. 0.6 GOI Bonds 4,000 1.0 Calculate: i. Expected rate of return in each case, using the Capital Asset Pricing Model (CAPM). ii. Average rate of return, if risk free rate of return is 14%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock