Question: Need detail solution QUESTION 3 Consider the following continuously-compounded spot yields for zero coupon bonds. Maturity (Years) Spot Yield 0.5 0.0500 1.0 0.0520 1.5 0.0510

Need detail solution

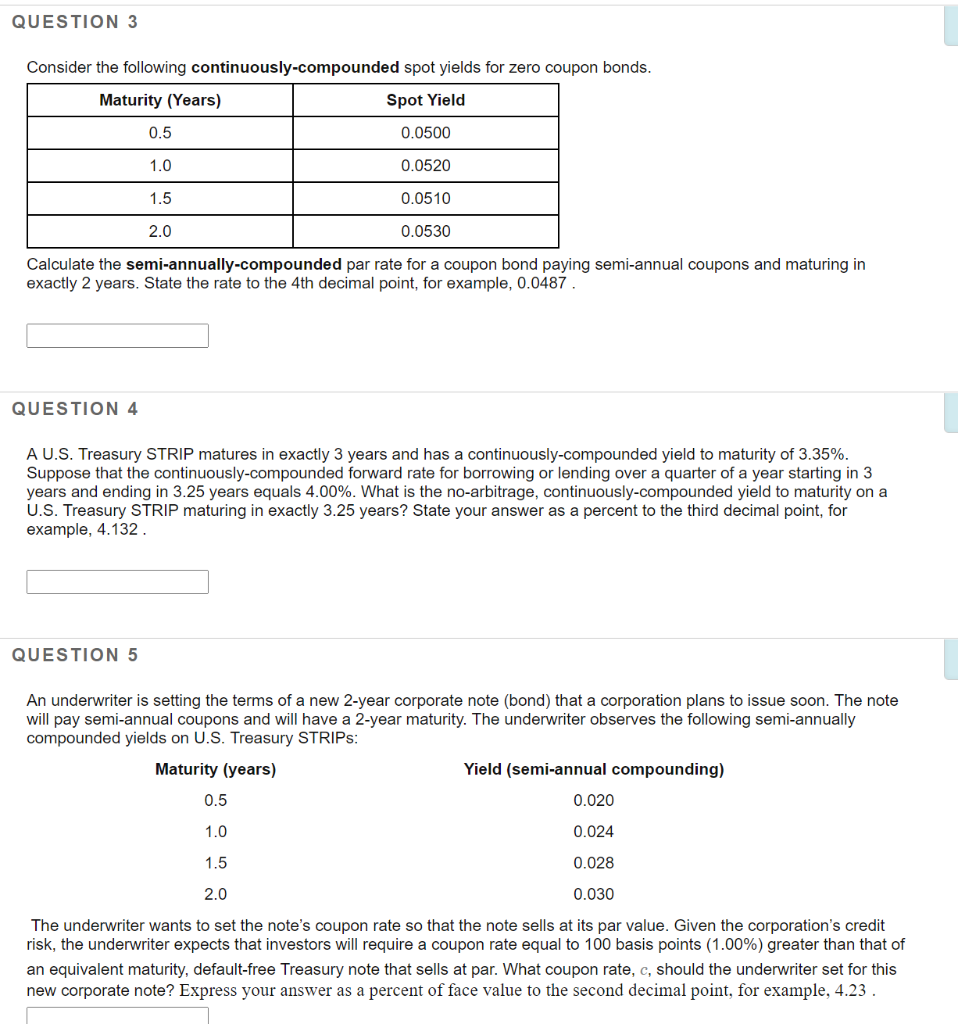

QUESTION 3 Consider the following continuously-compounded spot yields for zero coupon bonds. Maturity (Years) Spot Yield 0.5 0.0500 1.0 0.0520 1.5 0.0510 2.0 0.0530 Calculate the semi-annually-compounded par rate for a coupon bond paying semi-annual coupons and maturing in exactly 2 years. State the rate to the 4th decimal point, for example, 0.0487 QUESTION 4 A U.S. Treasury STRIP matures in exactly 3 years and has a continuously-compounded yield to maturity of 3.35%. Suppose that the continuously-compounded forward rate for borrowing or lending over a quarter of a year starting in 3 years and ending in 3.25 years equals 4.00%. What is the no-arbitrage, continuously-compounded yield to maturity on a U.S. Treasury STRIP maturing in exactly 3.25 years? State your answer as a percent to the third decimal point, for example, 4.132 QUESTION 5 An underwriter is setting the terms of a new 2-year corporate note (bond) that a corporation plans to issue soon. The note will pay semi-annual coupons and will have a 2-year maturity. The underwriter observes the following semi-annually compounded yields on U.S. Treasury STRIPs: Maturity (years) Yield (semi-annual compounding) 0.5 0.020 1.0 0.024 1.5 0.028 2.0 0.030 The underwriter wants to set the note's coupon rate so that the note sells at its par value. Given the corporation's credit risk, the underwriter expects that investors will require a coupon rate equal to 100 basis points (1.00%) greater than that of an equivalent maturity, default-free Treasury note that sells at par. What coupon rate, c, should the underwriter set for this new corporate note? Express your answer as a percent of face value to the second decimal point, for example, 4.23 . QUESTION 3 Consider the following continuously-compounded spot yields for zero coupon bonds. Maturity (Years) Spot Yield 0.5 0.0500 1.0 0.0520 1.5 0.0510 2.0 0.0530 Calculate the semi-annually-compounded par rate for a coupon bond paying semi-annual coupons and maturing in exactly 2 years. State the rate to the 4th decimal point, for example, 0.0487 QUESTION 4 A U.S. Treasury STRIP matures in exactly 3 years and has a continuously-compounded yield to maturity of 3.35%. Suppose that the continuously-compounded forward rate for borrowing or lending over a quarter of a year starting in 3 years and ending in 3.25 years equals 4.00%. What is the no-arbitrage, continuously-compounded yield to maturity on a U.S. Treasury STRIP maturing in exactly 3.25 years? State your answer as a percent to the third decimal point, for example, 4.132 QUESTION 5 An underwriter is setting the terms of a new 2-year corporate note (bond) that a corporation plans to issue soon. The note will pay semi-annual coupons and will have a 2-year maturity. The underwriter observes the following semi-annually compounded yields on U.S. Treasury STRIPs: Maturity (years) Yield (semi-annual compounding) 0.5 0.020 1.0 0.024 1.5 0.028 2.0 0.030 The underwriter wants to set the note's coupon rate so that the note sells at its par value. Given the corporation's credit risk, the underwriter expects that investors will require a coupon rate equal to 100 basis points (1.00%) greater than that of an equivalent maturity, default-free Treasury note that sells at par. What coupon rate, c, should the underwriter set for this new corporate note? Express your answer as a percent of face value to the second decimal point, for example, 4.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts