Question: need detailed calculation QUESTION 1 3 p Suppose that a dealer quotes a bank discount yield of 8.00% for a Treasury bill that has 180

need detailed calculation

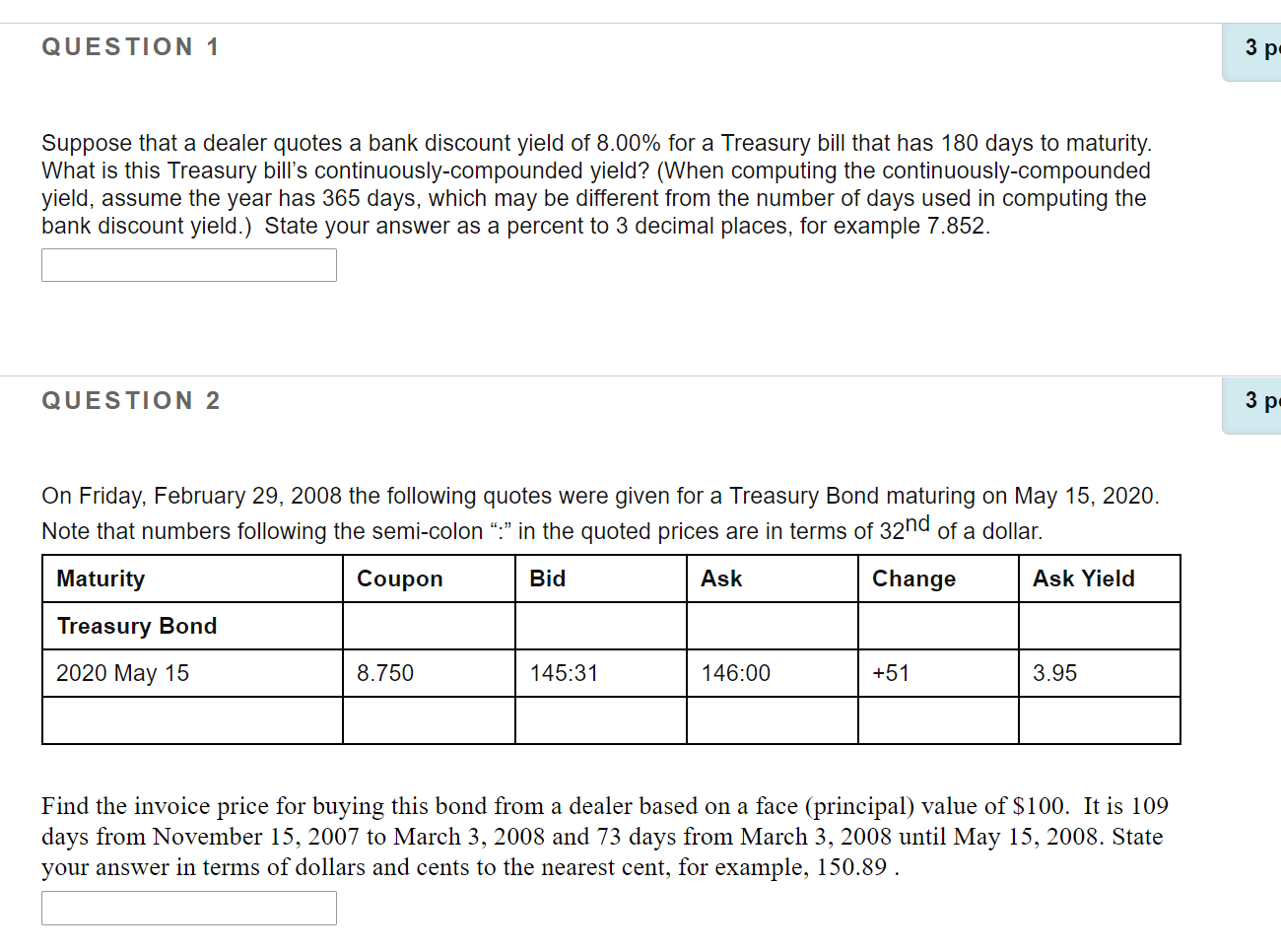

QUESTION 1 3 p Suppose that a dealer quotes a bank discount yield of 8.00% for a Treasury bill that has 180 days to maturity. What is this Treasury bill's continuously-compounded yield? (When computing the continuously-compounded yield, assume the year has 365 days, which may be different from the number of days used in computing the bank discount yield.) State your answer as a percent to 3 decimal places, for example 7.852. QUESTION 2 3 po On Friday, February 29, 2008 the following quotes were given for a Treasury Bond maturing on May 15, 2020. Note that numbers following the semi-colon ":" in the quoted prices are in terms of 32nd of a dollar. Maturity Coupon Bid Ask Change Ask Yield Treasury Bond 2020 May 15 8.750 145:31 146:00 +51 3.95 Find the invoice price for buying this bond from a dealer based on a face (principal) value of $100. It is 109 days from November 15, 2007 to March 3, 2008 and 73 days from March 3, 2008 until May 15, 2008. State your answer in terms of dollars and cents to the nearest cent, for example, 150.89. QUESTION 1 3 p Suppose that a dealer quotes a bank discount yield of 8.00% for a Treasury bill that has 180 days to maturity. What is this Treasury bill's continuously-compounded yield? (When computing the continuously-compounded yield, assume the year has 365 days, which may be different from the number of days used in computing the bank discount yield.) State your answer as a percent to 3 decimal places, for example 7.852. QUESTION 2 3 po On Friday, February 29, 2008 the following quotes were given for a Treasury Bond maturing on May 15, 2020. Note that numbers following the semi-colon ":" in the quoted prices are in terms of 32nd of a dollar. Maturity Coupon Bid Ask Change Ask Yield Treasury Bond 2020 May 15 8.750 145:31 146:00 +51 3.95 Find the invoice price for buying this bond from a dealer based on a face (principal) value of $100. It is 109 days from November 15, 2007 to March 3, 2008 and 73 days from March 3, 2008 until May 15, 2008. State your answer in terms of dollars and cents to the nearest cent, for example, 150.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts