Question: Need detailed information within 26 - 2 - 24 weeks Z Probability of not completing within 27 weeks 1(-) Probability of completing within 27 weeks

Need detailed information

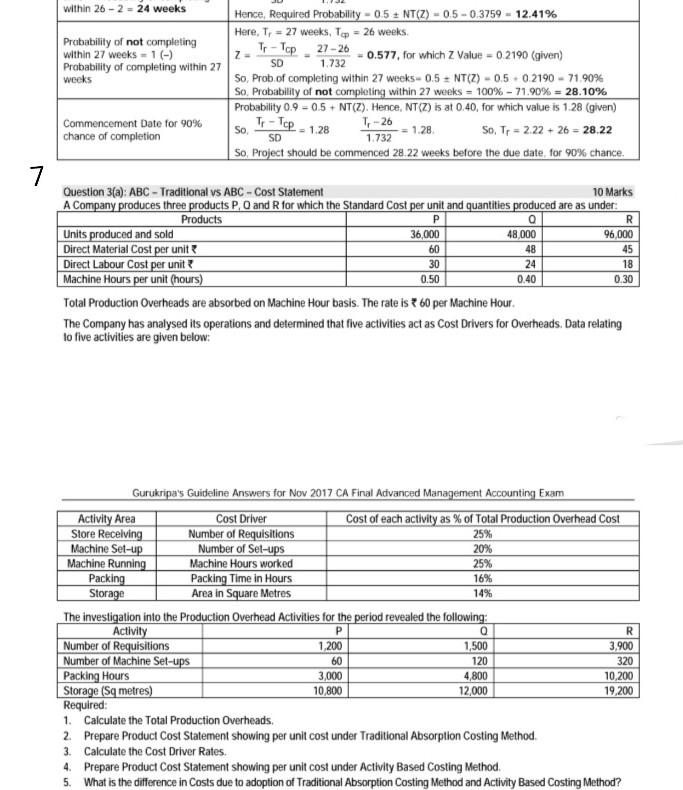

within 26 - 2 - 24 weeks Z Probability of not completing within 27 weeks 1(-) Probability of completing within 27 weeks SD Hence, Required Probability - 0.5 + NT(Z) = 0.5 -0.3759 - 12.41% Here, T = 27 weeks. To = 26 weeks Tr - Top 27-26 0.577, for which z Value = 0.2190 (given) 1.732 So, Prob.of completing within 27 weeks.0.5 NTCZ) -0.50 2190 - 71.90% So. Probability of not completing within 27 weeks = 100% - 71.90% = 28.10% Probability 0.9 -0.5 + NT(Z). Hence, NTCZ) is at 0.40, for which value is 1.28 (given) Ti-Top T, -26 = 1.28 1.28 1732 So, Tp = 2.22 + 26 = 28.22 So, Project should be commenced 28 22 weeks before the due date for 90% chance Commencement Date for 90% chance of completion So SD 7 P R Question 3(a): ABC - Traditional vs ABC - Cost Statement 10 Marks A Company produces three products P, Q and R for which the Standard Cost per unit and quantities produced are as under: Products 0 Units produced and sold 36,000 48,000 96,000 Direct Material Cost per unit? 48 45 Direct Labour Cost per unit? 18 Machine Hours per unit (hours) 0.40 0.30 Total Production Overheads are absorbed on Machine Hour basis. The rate is 60 per Machine Hour. The Company has analysed its operations and determined that five activities act as Cost Drivers for Overheads. Data relating to live activities are given below: 60 30 0.50 24 16% Gurukripa's Guideline Answers for Nov 2017 CA Final Advanced Management Accounting Exam Activity Area Cost Driver Cost of each activity as % of Total Production Overhead Cost Store Receiving Number of Requisitions 25% Machine Set-up Number of Set-ups 20% Machine Running Machine Hours worked 25% Packing Packing Time in Hours Storage Area in Square Metres 14% The investigation into the Production Overhead Activities for the period revealed the following: Activity Q Number of Requisitions 1,200 1,500 3,900 Number of Machine Set-ups 120 Packing Hours 3,000 4,800 10,200 Storage (Sq metres) 10,800 12.000 19,200 Required: 1. Calculate the Total Production Overheads 2. Prepare Product Cost Statement showing per unit cost under Traditional Absorption Costing Method 3. Calculate the Cost Driver Rates. 4. Prepare Product Cost Statement showing per unit cost under Activity Based Costing Method. 5. What is the difference in Costs due to adoption of Traditional Absorption Costing Method and Activity Based Costing Method? R 60 320Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock