Question: NEED EVERY ANSWER TO C PLEASE Sam is considering buying a new lawnmower. He has a choice between a Lawn Guy mower and a Bargain

NEED EVERY ANSWER TO C PLEASE

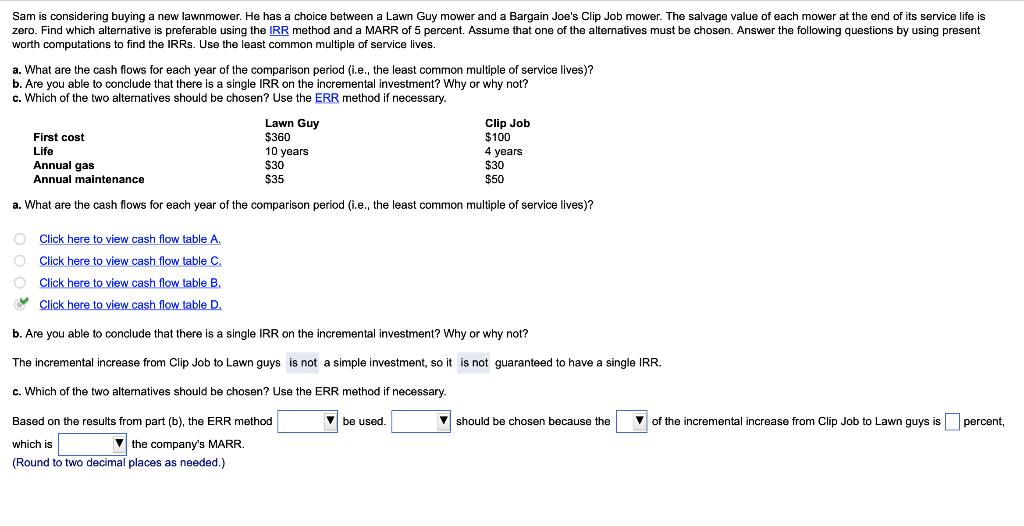

Sam is considering buying a new lawnmower. He has a choice between a Lawn Guy mower and a Bargain Joe's Clip Job mower. The salvage value of each mower at the end of its service life is zero. Find which alternative is preferable using the IRR method and a MARR of 5 percent. Assume that one of the alternatives must be chosen. Answer the following questions by using present worth computations to find the IRRs. Use the least common multiple of service lives. a. What are the cash flows for each year of the comparison period (i.e., the least common multiple of service lives)? b. Are you able to conclude that there is a single IRR on the incremental investment? Why or why not? c. Which of the two alternatives should be chosen? Use the ERR method if necessary. a. What are the cash flows for each year of the comparison period (i.e., the least common multiple of service lives)? Click here to view cash flow table C. Click here to view cash flow table B. b. Are you able to conclude that there is a single IRR on the incremental investment? Why or why not? The incremental increase from Clip Job to Lawn guys a simple investment, so it guaranteed to have a single IRR. c. Which of the two alternatives should be chosen? Use the ERR method if necessary. Based on the results from part (b), the ERR method be used. should be chosen because the of the incremental increase from Clip Job to Lawn guys is percht, which is the company's MARR. (Round to two decimal places as needed.) Sam is considering buying a new lawnmower. He has a choice between a Lawn Guy mower and a Bargain Joe's Clip Job mower. The salvage value of each mower at the end of its service life is zero. Find which alternative is preferable using the IRR method and a MARR of 5 percent. Assume that one of the alternatives must be chosen. Answer the following questions by using present worth computations to find the IRRs. Use the least common multiple of service lives. a. What are the cash flows for each year of the comparison period (i.e., the least common multiple of service lives)? b. Are you able to conclude that there is a single IRR on the incremental investment? Why or why not? c. Which of the two alternatives should be chosen? Use the ERR method if necessary. a. What are the cash flows for each year of the comparison period (i.e., the least common multiple of service lives)? Click here to view cash flow table C. Click here to view cash flow table B. b. Are you able to conclude that there is a single IRR on the incremental investment? Why or why not? The incremental increase from Clip Job to Lawn guys a simple investment, so it guaranteed to have a single IRR. c. Which of the two alternatives should be chosen? Use the ERR method if necessary. Based on the results from part (b), the ERR method be used. should be chosen because the of the incremental increase from Clip Job to Lawn guys is percht, which is the company's MARR. (Round to two decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts