Question: need every step to get full credit. excel format 3) Bob's Rawhide Company has a dividend payout ratio of 65%. Next year it will earn

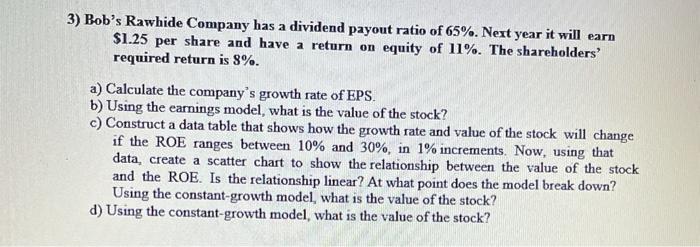

3) Bob's Rawhide Company has a dividend payout ratio of 65%. Next year it will earn $1.25 per share and have a return on equity of 11%. The shareholders' required return is 8%. a) Calculate the company's growth rate of EPS. b) Using the earnings model, what is the value of the stock? c) Construct a data table that shows how the growth rate and value of the stock will change if the ROE ranges between 10% and 30%, in 1% increments. Now, using that data, create a scatter chart to show the relationship between the value of the stock and the ROE. Is the relationship linear? At what point does the model break down? Using the constant-growth model, what is the value of the stock? d) Using the constant-growth model, what is the value of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts