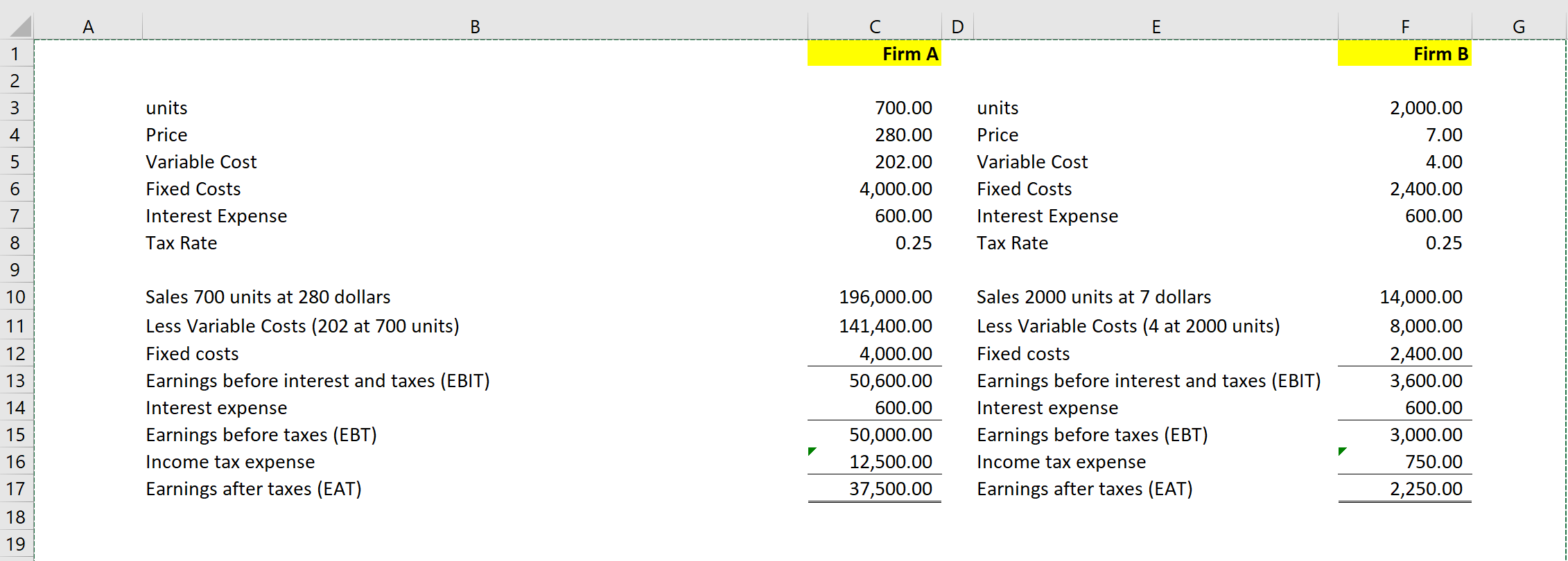

Question: Need Excel Formulas for part 1 and answer for part 2. For reference, numbers for Firm A is column C and rows 3 - 17

Need Excel Formulas for part 1 and answer for part 2. For reference, numbers for Firm A is column C and rows 3 - 17 and Firm B is column F and rows 3 - 17.

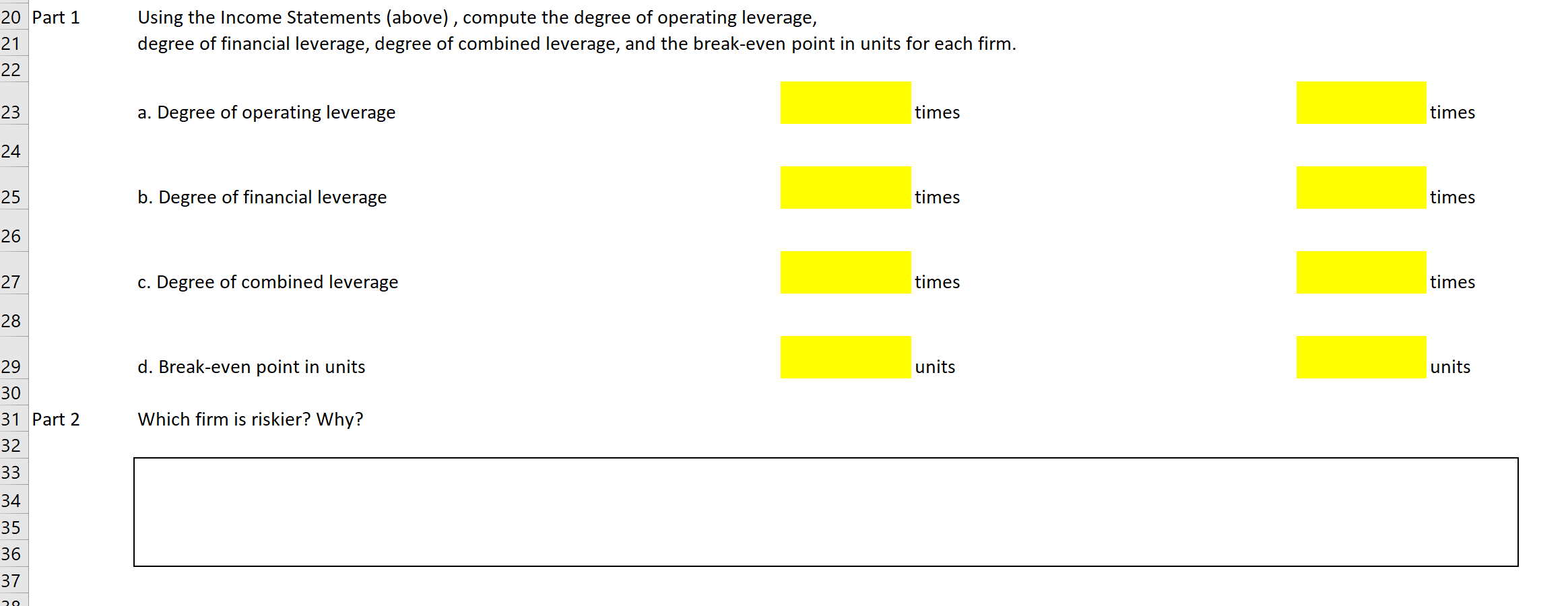

c Firm A Firm B nm or 00 units Price Variable Cost Fixed Costs Interest Expense Tax Rate 700.00 280.00 202.00 4,000.00 600.00 0.25 units Price Variable Cost Fixed Costs Interest Expense Tax Rate 2,000.00 7.00 4.00 2,400.00 600.00 0.25 10 11 12 13 Sales 700 units at 280 dollars Less Variable Costs (202 at 700 units) Fixed costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Income tax expense Earnings after taxes (EAT) 196,000.00 141,400.00 4,000.00 50,600.00 600.00 50,000.00 12,500.00 37,500.00 Sales 2000 units at 7 dollars Less Variable Costs (4 at 2000 units) Fixed costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Income tax expense Earnings after taxes (EAT) 14,000.00 8,000.00 2,400.00 3,600.00 600.00 3,000.00 750.00 2,250.00 14 15 16 17 18 19 20 Part 1 Using the Income Statements (above), compute the degree of operating leverage, degree of financial leverage, degree of combined leverage, and the break-even point in units for each firm. 21 a. Degree of operating leverage times times b. Degree of financial leverage times times c. Degree of combined leverage times times d. Break-even point in units units units 30 Which firm is riskier? Why? 31 Part 2 32 33 34 35 36 37 29 c Firm A Firm B nm or 00 units Price Variable Cost Fixed Costs Interest Expense Tax Rate 700.00 280.00 202.00 4,000.00 600.00 0.25 units Price Variable Cost Fixed Costs Interest Expense Tax Rate 2,000.00 7.00 4.00 2,400.00 600.00 0.25 10 11 12 13 Sales 700 units at 280 dollars Less Variable Costs (202 at 700 units) Fixed costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Income tax expense Earnings after taxes (EAT) 196,000.00 141,400.00 4,000.00 50,600.00 600.00 50,000.00 12,500.00 37,500.00 Sales 2000 units at 7 dollars Less Variable Costs (4 at 2000 units) Fixed costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Income tax expense Earnings after taxes (EAT) 14,000.00 8,000.00 2,400.00 3,600.00 600.00 3,000.00 750.00 2,250.00 14 15 16 17 18 19 20 Part 1 Using the Income Statements (above), compute the degree of operating leverage, degree of financial leverage, degree of combined leverage, and the break-even point in units for each firm. 21 a. Degree of operating leverage times times b. Degree of financial leverage times times c. Degree of combined leverage times times d. Break-even point in units units units 30 Which firm is riskier? Why? 31 Part 2 32 33 34 35 36 37 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts