Question: need explanation please Saved Homework Check my work Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using

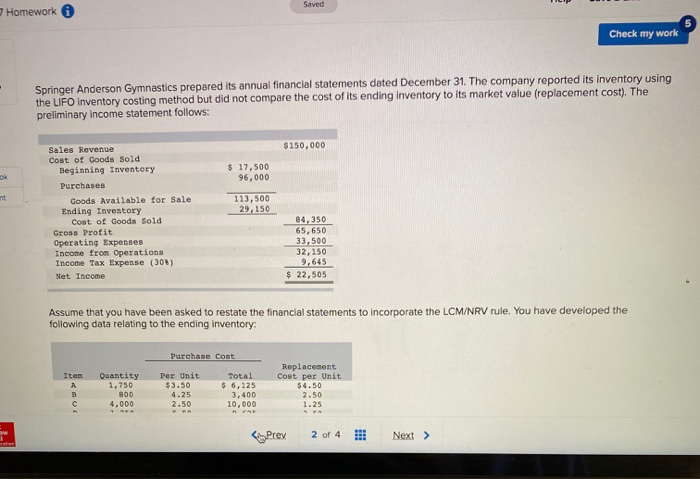

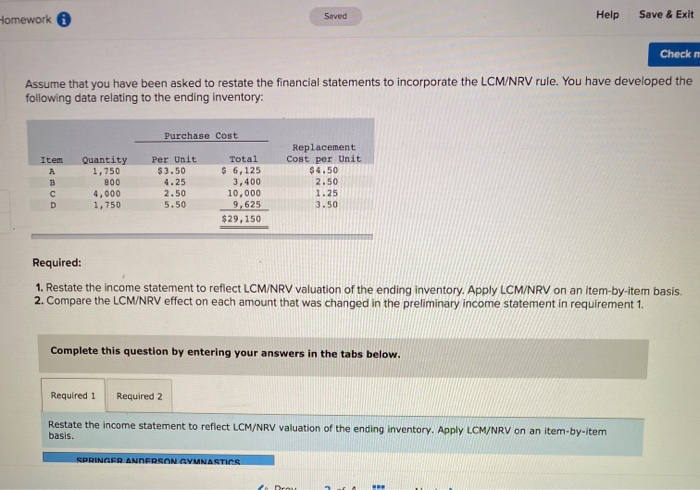

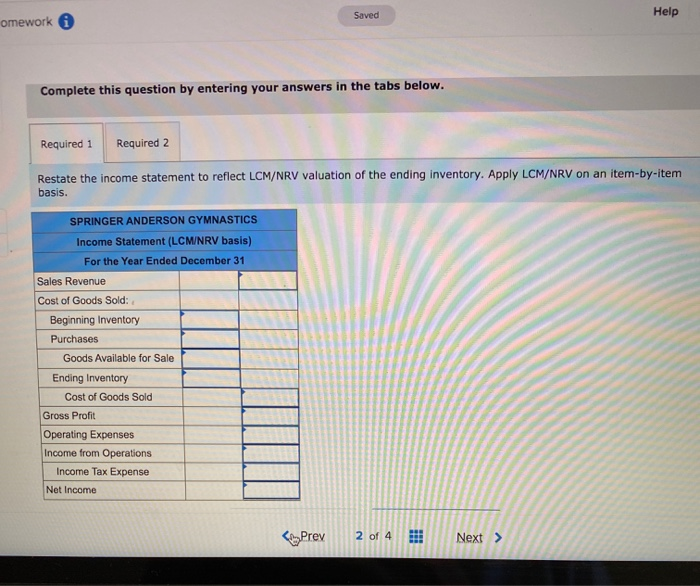

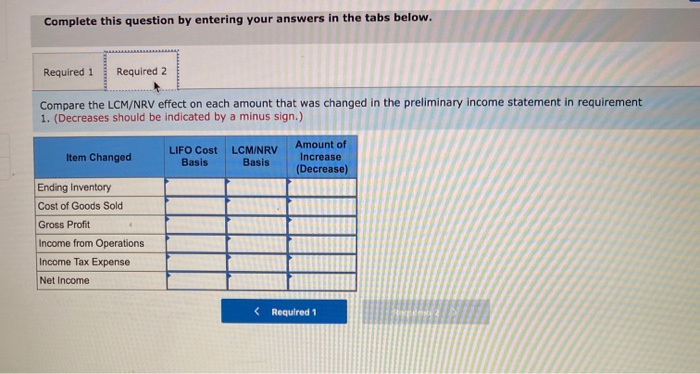

Saved Homework Check my work Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: $150,000 $ 17.500 96,000 113,500 29,150 Sales Revenue Cost of Goods Sold Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (308) Net Income 84.350 65,650 33.500 32,150 9.645 $ 22,505 Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Item Replacement Cost per Unit Quantity 1.750 800 4.000 Per Unit $3,50 4.25 2.50 Total $ 6,125 3,400 10,000 2.50 Prey 2 of 4 !! Next > Homework Saved Help Save & Exit Check Assume that you have been asked to restate the financial statements to incorporate the LCMNRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Item Quantity 1,750 800 4,000 1,750 Per Unit $3.50 4.25 2.50 5.50 Total $ 6,125 3,400 10,000 9.625 $29,150 Replacement Cost per Unit $4.50 2.50 1.25 3. So Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. SPRINGER ANDERSON MNASTICS Saved Help omework Complete this question by entering your answers in the tabs below. Required 1 Required 2 Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. SPRINGER ANDERSON GYMNASTICS Income Statement (LCM/NRV basis) For the Year Ended December 31 Sales Revenue Cost of Goods Sold: Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense Net Income Homework Saved Help Save & Exit Check Assume that you have been asked to restate the financial statements to incorporate the LCMNRV rule. You have developed the following data relating to the ending inventory: Purchase Cost Item Quantity 1,750 800 4,000 1,750 Per Unit $3.50 4.25 2.50 5.50 Total $ 6,125 3,400 10,000 9.625 $29,150 Replacement Cost per Unit $4.50 2.50 1.25 3. So Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. SPRINGER ANDERSON MNASTICS Saved Help omework Complete this question by entering your answers in the tabs below. Required 1 Required 2 Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. SPRINGER ANDERSON GYMNASTICS Income Statement (LCM/NRV basis) For the Year Ended December 31 Sales Revenue Cost of Goods Sold: Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts