Question: Need Explanations. Show all calculations. Question #8 (20 POINTS) Presented below are the condensed financial statements of Fred & Wilma Enterprises: FRED & WILMA ENTERPRISES

Need Explanations. Show all calculations.

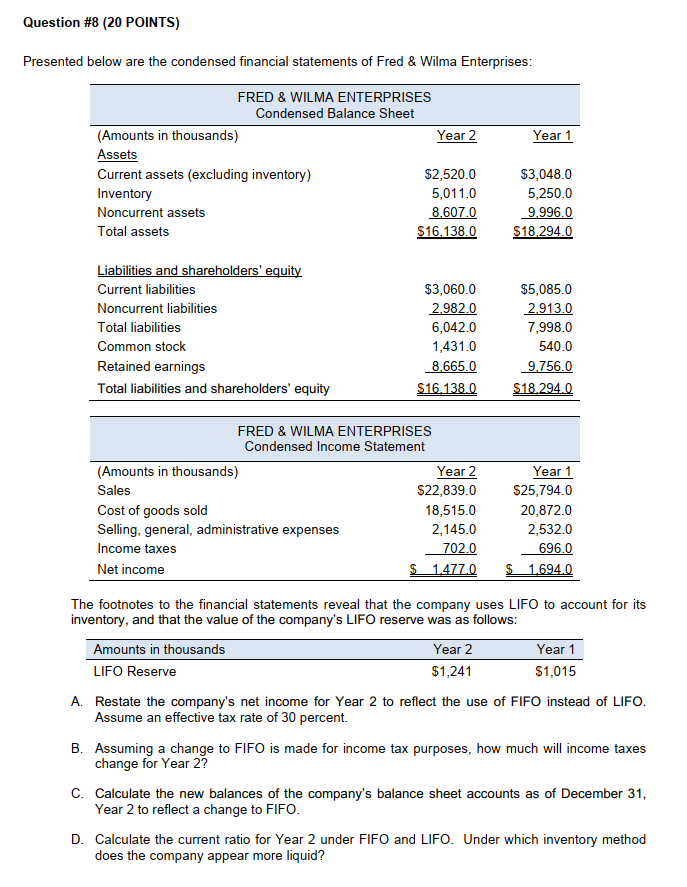

Question #8 (20 POINTS) Presented below are the condensed financial statements of Fred & Wilma Enterprises: FRED & WILMA ENTERPRISES Condensed Balance Sheet (Amounts in thousands) Year 2 Year 1 Assets Current assets (excluding inventory) $2,520.0 $3,048.0 Inventory 5,011.0 5,250.0 Noncurrent assets 8.607.0 9.996.0 Total assets $16.138.0 $18,294.0 Liabilities and shareholders' equity Current liabilities Noncurrent liabilities Total liabilities Common stock Retained earnings Total liabilities and shareholders' equity $3,060.0 2.982.0 6,042.0 1,431.0 8.665.0 $16.138.0 $5,085.0 2.913.0 7,998.0 540.0 9,756.0 $18.294.0 FRED & WILMA ENTERPRISES Condensed Income Statement (Amounts in thousands) Year 2 Sales $22,839.0 Cost of goods sold 18,515.0 Selling, general, administrative expenses 2,145.0 Income taxes 702.0 Net income $ 1.477.0 Year 1 $25,794.0 20,872.0 2,532.0 696.0 $ 1.694.0 The footnotes to the financial statements reveal that the company uses LIFO to account for its inventory, and that the value of the company's LIFO reserve was as follows: Amounts in thousands Year 2 Year 1 LIFO Reserve $1,241 $1,015 A. Restate the company's net income for Year 2 to reflect the use of FIFO instead of LIFO. Assume an effective tax rate of 30 percent. B. Assuming a change to FIFO is made for income tax purposes, how much will income taxes change for Year 27 C. Calculate the new balances of the company's balance sheet accounts as of December 31, Year 2 to reflect a change to FIFO. D. Calculate the current ratio for Year 2 under FIFO and LIFO. Under which inventory method does the company appear more liquid? Question #8 (20 POINTS) Presented below are the condensed financial statements of Fred & Wilma Enterprises: FRED & WILMA ENTERPRISES Condensed Balance Sheet (Amounts in thousands) Year 2 Year 1 Assets Current assets (excluding inventory) $2,520.0 $3,048.0 Inventory 5,011.0 5,250.0 Noncurrent assets 8.607.0 9.996.0 Total assets $16.138.0 $18,294.0 Liabilities and shareholders' equity Current liabilities Noncurrent liabilities Total liabilities Common stock Retained earnings Total liabilities and shareholders' equity $3,060.0 2.982.0 6,042.0 1,431.0 8.665.0 $16.138.0 $5,085.0 2.913.0 7,998.0 540.0 9,756.0 $18.294.0 FRED & WILMA ENTERPRISES Condensed Income Statement (Amounts in thousands) Year 2 Sales $22,839.0 Cost of goods sold 18,515.0 Selling, general, administrative expenses 2,145.0 Income taxes 702.0 Net income $ 1.477.0 Year 1 $25,794.0 20,872.0 2,532.0 696.0 $ 1.694.0 The footnotes to the financial statements reveal that the company uses LIFO to account for its inventory, and that the value of the company's LIFO reserve was as follows: Amounts in thousands Year 2 Year 1 LIFO Reserve $1,241 $1,015 A. Restate the company's net income for Year 2 to reflect the use of FIFO instead of LIFO. Assume an effective tax rate of 30 percent. B. Assuming a change to FIFO is made for income tax purposes, how much will income taxes change for Year 27 C. Calculate the new balances of the company's balance sheet accounts as of December 31, Year 2 to reflect a change to FIFO. D. Calculate the current ratio for Year 2 under FIFO and LIFO. Under which inventory method does the company appear more liquid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts