Question: Need form 1120 P Enter Shift Alt Fn Ctrl Delete End PgDn 7 Home 4 PgUp 1 End 2 2-> m + PgDn Enter 0

Need form 1120

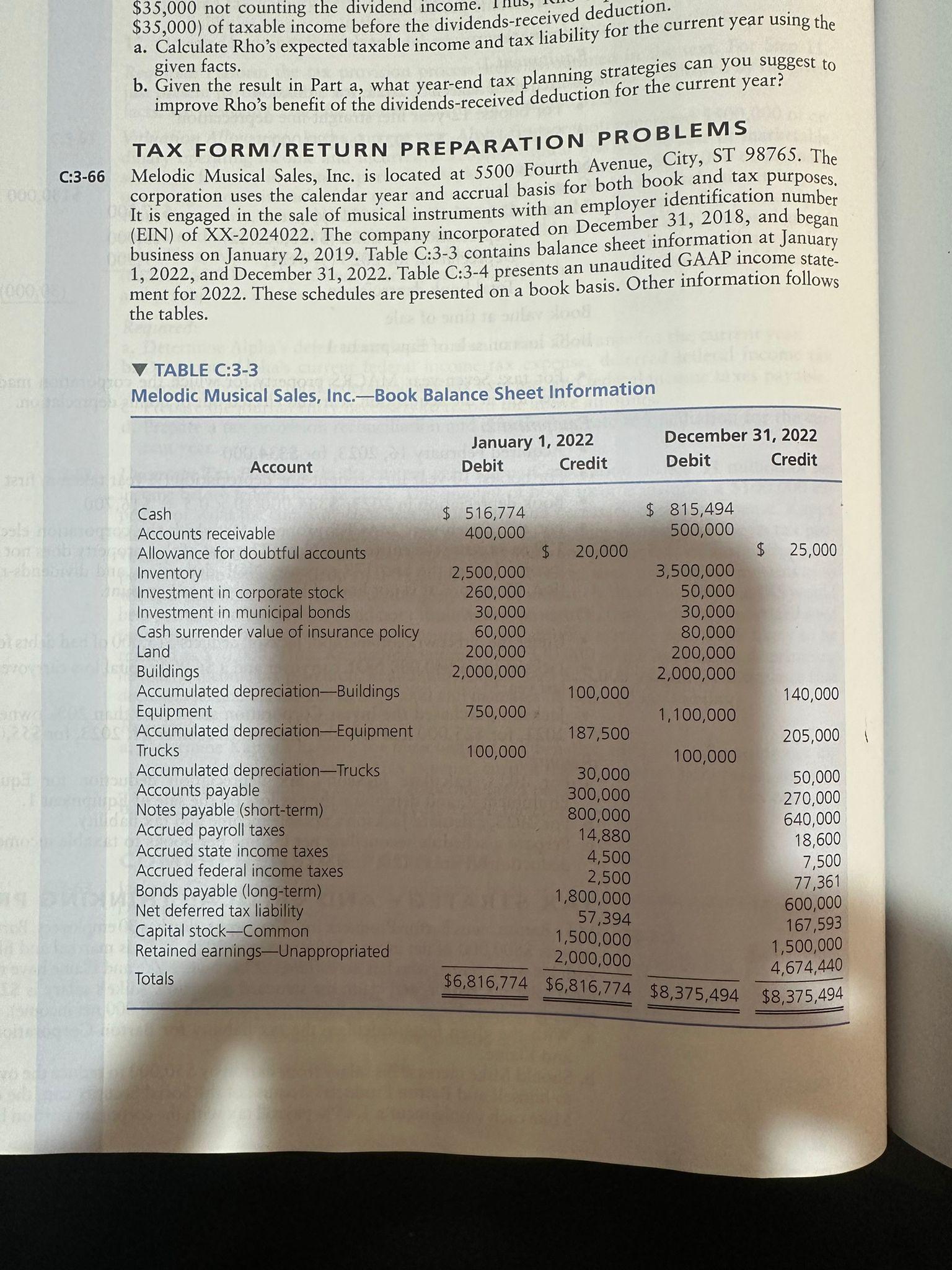

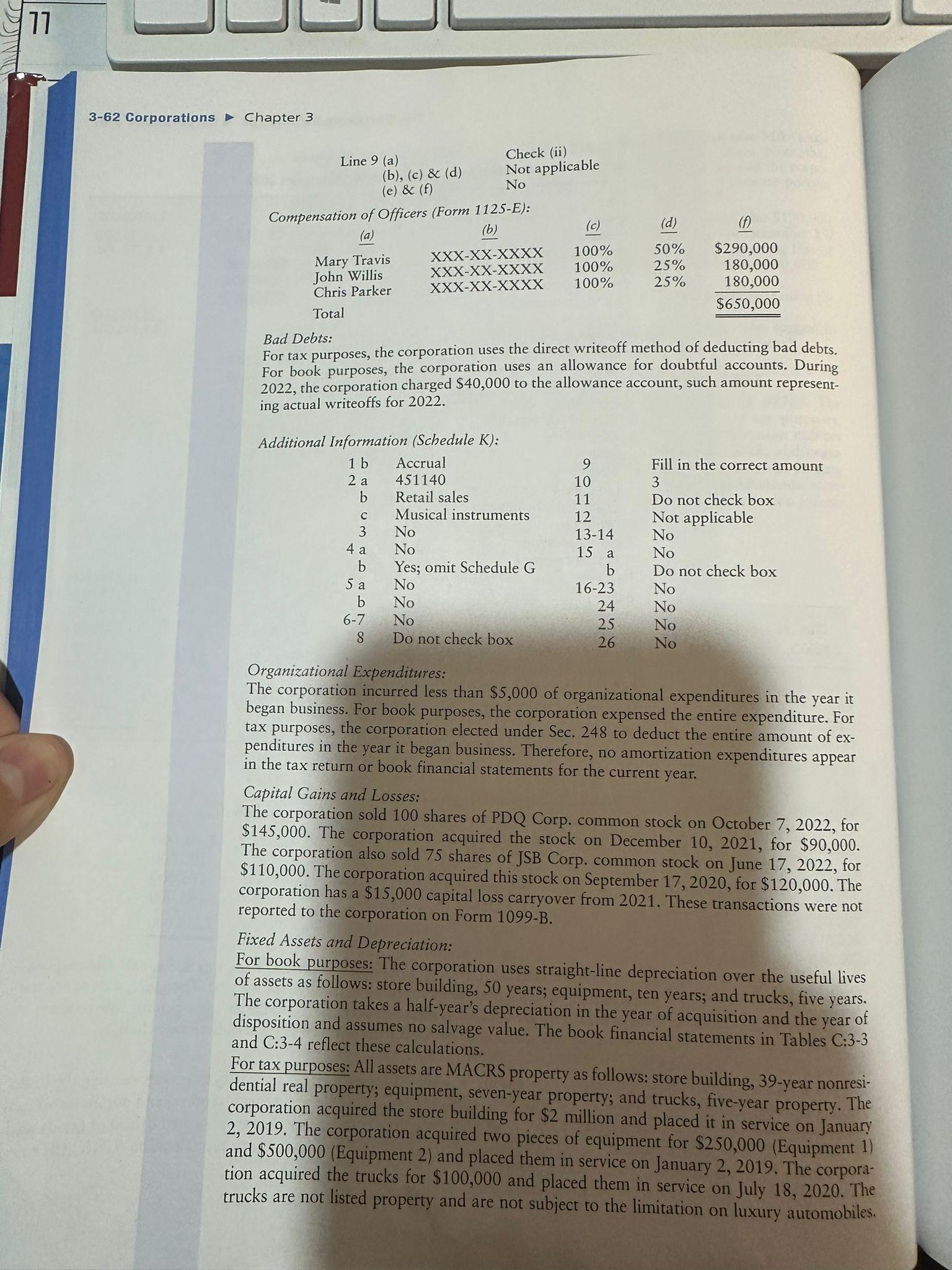

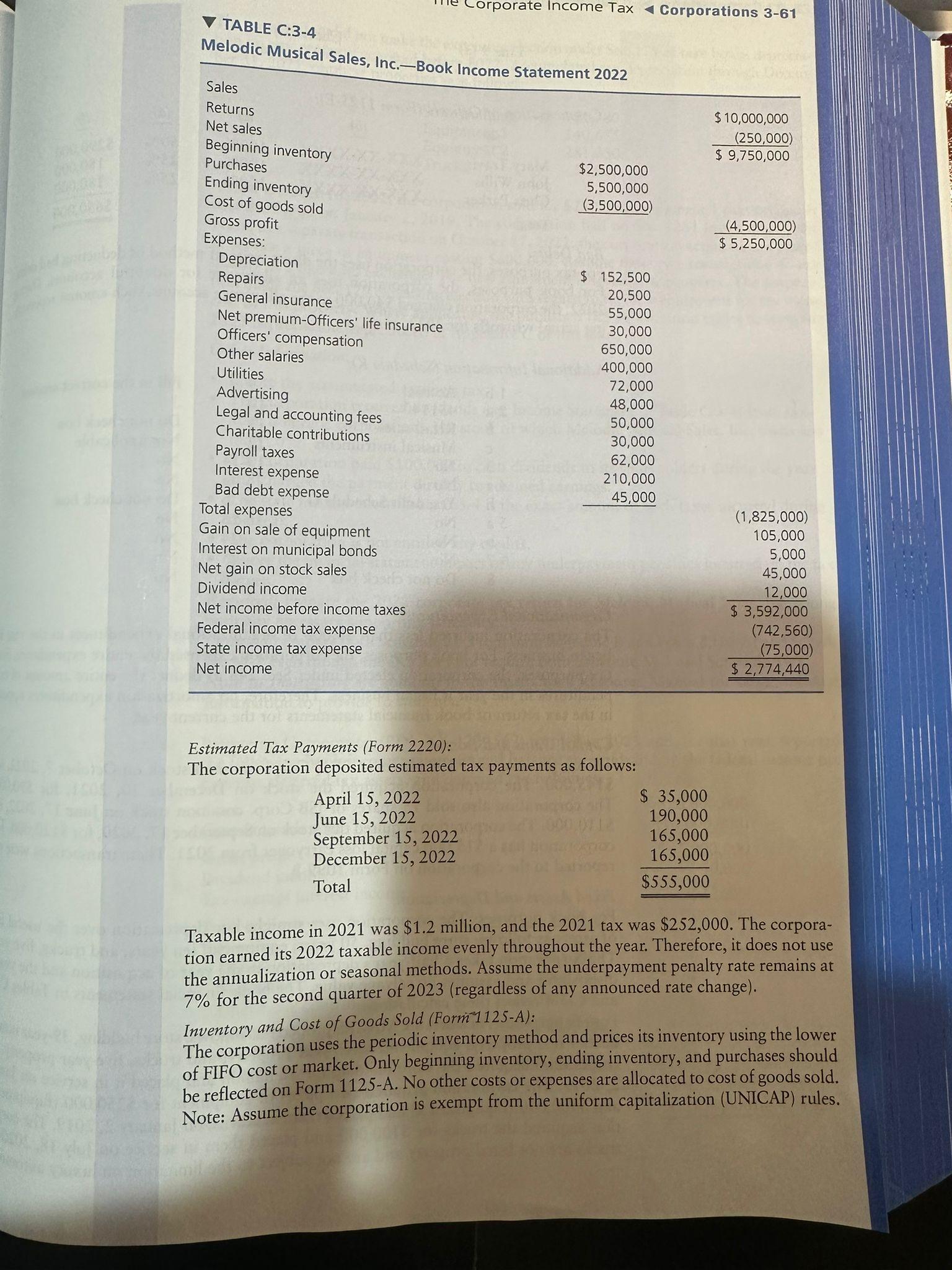

P Enter Shift Alt Fn Ctrl Delete End PgDn 7 Home 4 PgUp 1 End 2 2-> m + PgDn Enter 0 ->. Insert Delete 000,01 900 The Corporate Income Tax Corporations 3-63 The corporation did not make the expensing election under Sec. 179 or take bonus deprecia- tion on any property acquired before 2022. Accumulated tax depreciation through Decem- ber 31, 2021, on these properties is as follows: Store building Equipment 1 Equipment 2 Trucks $ 151,780 140,675 281,350 52,000 On October 16, 2022, the corporation sold for $280,000 Equipment 1 that originally cost $250,000 on January 2, 2019. The corporation had no Sec. 1231 losses from prior years. In a separate transaction on October 17, 2022, the corporation acquired and placed in service a piece of equipment costing $600,000. Assume these two transactions do not qualify as a like-kind exchange. The new equipment is seven-year property. The tion made the Sec. 179 expensing election with regard to the new equipment for the entire cost of this property. Where applicable, use published IRS depreciation tables to compute 2022 depreciation (reproduced in Appendix C of this text). Other Information: Ignore the accumulated earnings tax. corpora- The corporation received dividends (see Income Statement in Table C:3-4) from tax- able, domestic corporations, the stock of which Melodic Musical Sales, Inc. owns less than 20%. The corporation paid $100,000 in cash dividends to its shareholders during the year and charged the payment directly to retained earnings. The state income tax in Table C:3-4 is the exact amount of such taxes incurred during the year. The corporation is not entitled any credits. Ignore the financial statement impact of any underpayment penalties incurred on the tax return. Required: Prepare the 2022 corporate tax return for Melodic Musical Sales, Inc. along with any necessary supporting schedules. Optional: Prepare both Schedule M-3 (but omit Schedule B and Form 8916-A) and Sched- ule M-1 even though the IRS does not require both Schedule M-1 and Schedule M-3. Note to Instructor: See solution in the Instructor's Resource Manual for other optional information to provide to students. tion (EIN: XX-1234567) formed in 2021 and, for that year, reported

Step by Step Solution

There are 3 Steps involved in it

It seems that you have provided multiple images containing information about a corporation Melodic Musical Sales Inc and have requested the preparatio... View full answer

Get step-by-step solutions from verified subject matter experts