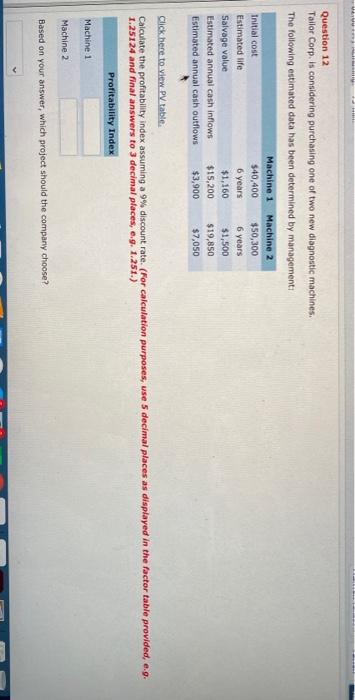

Question: need full answers Question 12 Tailor Corp. is considering purchasing one of two new diagnostic machines. The following estimated data has been determined by management

Question 12 Tailor Corp. is considering purchasing one of two new diagnostic machines. The following estimated data has been determined by management Initial cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows Machine 1 $40,400 6 years $1,160 $15,200 $3,900 Machine 2 $50,300 6 years $1,500 $19,850 $7,050 Click here to view Pvtable. Calculate the profitability index assuming a 9% discount rate. (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.. 1.25124 and final answers to 3 decimal places, e.g. 1.251.) Profitability Index Machine 1 Machine 2 Based on your answer, which project should the company choose

Step by Step Solution

There are 3 Steps involved in it

Lets solve the problem step by step Given Data Machine 1 Machine 2 Initial Cost 40400 50300 Estimate... View full answer

Get step-by-step solutions from verified subject matter experts