Question: Need full Explanation and Calculation. Thank you. Below excel is for reference. 1. The following shows a partial listing of T-bills from the Wall Street

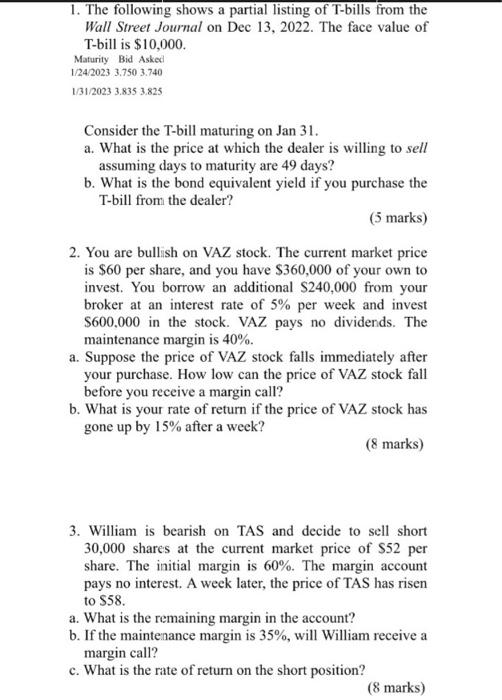

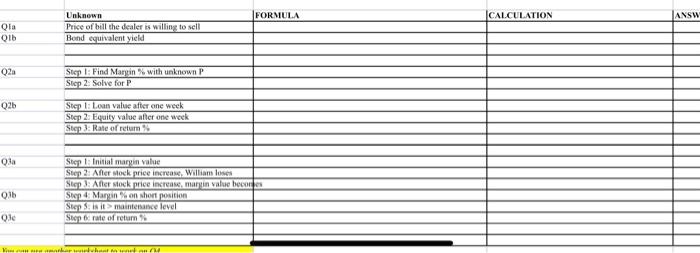

1. The following shows a partial listing of T-bills from the Wall Street Journal on Dec 13, 2022. The face value of T-bill is $10,000. Maturity Bid Asked 1/24/20233.7503.740 1/31/20233.8353.825 Consider the T-bill maturing on Jan 31 . a. What is the price at which the dealer is willing to sell assuming days to maturity are 49 days? b. What is the bond equivalent yield if you purchase the T-bill from the dealer? ( 5 marks) 2. You are bullish on VAZ stock. The current market price is $60 per share, and you have $360,000 of your own to invest. You borrow an additional $240,000 from your broker at an interest rate of 5% per week and invest $600,000 in the stock. VAZ pays no dividends. The maintenance margin is 40%. a. Suppose the price of VAZ stock falls immediately after your purchase. How low can the price of VAZ stock fall before you receive a margin call? b. What is your rate of return if the price of VAZ stock has gone up by 15% after a week? ( 8 marks) 3. William is bearish on TAS and decide to sell short 30,000 shares at the current market price of $52 per share. The initial margin is 60%. The margin account pays no interest. A week later, the price of TAS has risen to $58. a. What is the remaining margin in the account? b. If the maintenance margin is 35%, will William receive a margin call? c. What is the rate of return on the short position? ( 8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts