Question: need full prove or explanation to work though the question (1) (2) Assume that the prices, A4 and Yt, of risky assets satisfy the equations

need full prove or explanation to work though the question

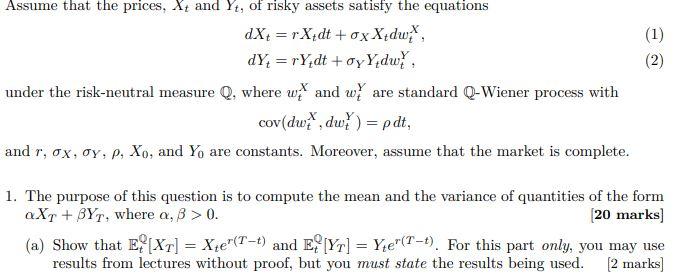

(1) (2) Assume that the prices, A4 and Yt, of risky assets satisfy the equations dX+ =rXidt +ox X dw, dY= rYdt + oyYdwy under the risk-neutral measure Q, where we and ware standard Q-Wiener process with cov(dw.dw.) = pdt, and r, ox, oy, p. Xo, and Yo are constants. Moreover, assume that the market is complete. 1. The purpose of this question is to compute the mean and the variance of quantities of the form aX1 + BYt, where a, 3 > 0. 20 marks) (a) Show that E[Xr) = Xte"(T-t) and E. [Yr] = Yie"(T-1). For this part only, you may use results from lectures without proof, but you must state the results being used. (2 marks] (1) (2) Assume that the prices, A4 and Yt, of risky assets satisfy the equations dX+ =rXidt +ox X dw, dY= rYdt + oyYdwy under the risk-neutral measure Q, where we and ware standard Q-Wiener process with cov(dw.dw.) = pdt, and r, ox, oy, p. Xo, and Yo are constants. Moreover, assume that the market is complete. 1. The purpose of this question is to compute the mean and the variance of quantities of the form aX1 + BYt, where a, 3 > 0. 20 marks) (a) Show that E[Xr) = Xte"(T-t) and E. [Yr] = Yie"(T-1). For this part only, you may use results from lectures without proof, but you must state the results being used. (2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts