Question: need full solution After two years of the first five-year term at 6.9% compounded semiannually, Dan and Laurel decide to take ivilege of increasing the

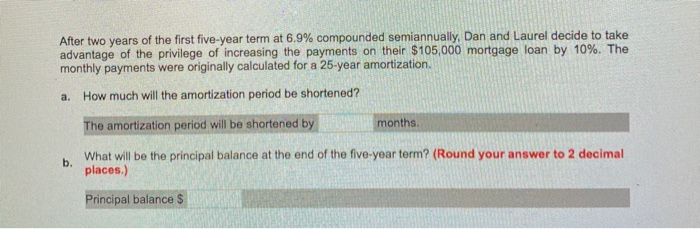

After two years of the first five-year term at 6.9% compounded semiannually, Dan and Laurel decide to take ivilege of increasing the payments on their $105,000 mortgage loan by 10%. The monthly payments were originally calculated for a 25-year amortization a. How much will the amortization period be shortened? The amortization period will be shortened by months. What will be the principal balance at the end of the five-year term? (Round your answer to 2 decimal places.) Principal balance $ After two years of the first five-year term at 6.9% compounded semiannually, Dan and Laurel decide to take ivilege of increasing the payments on their $105,000 mortgage loan by 10%. The monthly payments were originally calculated for a 25-year amortization a. How much will the amortization period be shortened? The amortization period will be shortened by months. What will be the principal balance at the end of the five-year term? (Round your answer to 2 decimal places.) Principal balance $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts