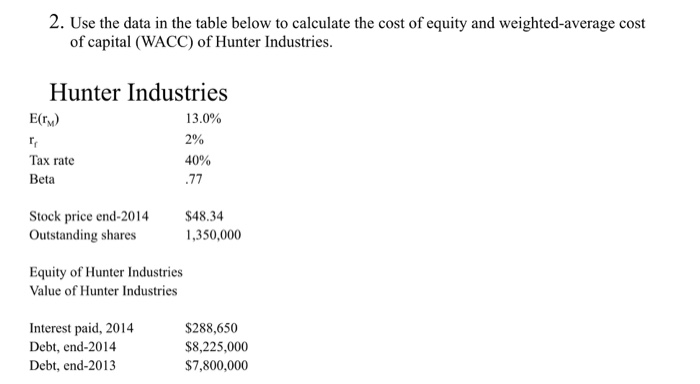

Question: need guidance 2. Use the data in the table below to calculate the cost of equity and weighted-average cost of capital (WACC) of Hunter Industries.

2. Use the data in the table below to calculate the cost of equity and weighted-average cost of capital (WACC) of Hunter Industries. Hunter Industries E(r,) 13 .0% 2% 40% Tax rate Beta Stock price end-2014 Outstanding shares $48.34 1,350,000 Equity of Hunter Industries Value of Hunter Industries Interest paid, 2014 Debt, end-2014 Debt, end-2013 $288,650 $8,225,000 $7,800,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts