Question: need guidance with part B, part a is not required. Question 1: ABC Inc stock is launching a new product tomorrow and a trader wishes

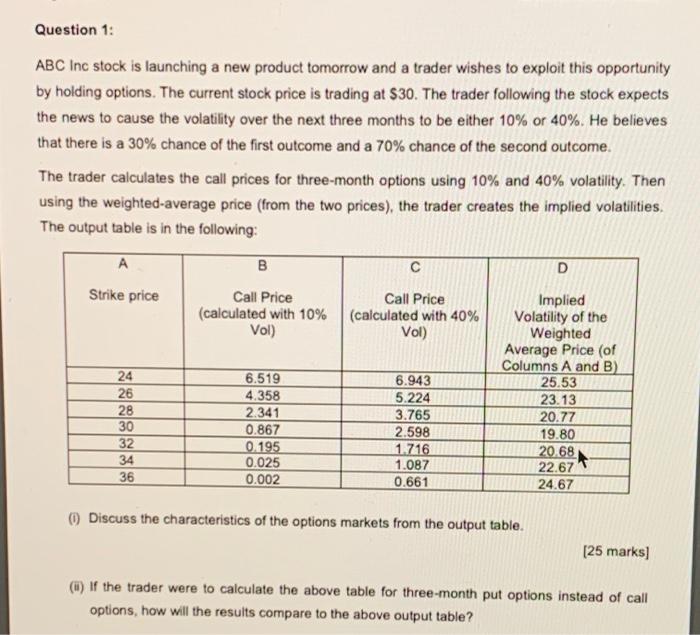

Question 1: ABC Inc stock is launching a new product tomorrow and a trader wishes to exploit this opportunity by holding options. The current stock price is trading at $30. The trader following the stock expects the news to cause the volatility over the next three months to be either 10% or 40%. He believes that there is a 30% chance of the first outcome and a 70% chance of the second outcome. The trader calculates the call prices for three month options using 10% and 40% volatility. Then using the weighted average price from the two prices), the trader creates the implied volatilities The output table is in the following: A B D Strike price Call Price Call Price (calculated with 10% (calculated with 40% Vol) Vol) 24 26 28 6.519 4.358 2.341 0.867 0.195 0.025 0.002 30 Implied Volatility of the Weighted Average Price (of Columns A and B) 25.53 23.13 20.77 19.80 20.68 22.67 24.67 6.943 5.224 3.765 2.598 1.716 1.087 0.661 32 34 36 0) Discuss the characteristics of the options markets from the output table. [25 marks] (6) If the trader were to calculate the above table for three-month put options instead of call options, how will the results compare to the above output table? Question 1: ABC Inc stock is launching a new product tomorrow and a trader wishes to exploit this opportunity by holding options. The current stock price is trading at $30. The trader following the stock expects the news to cause the volatility over the next three months to be either 10% or 40%. He believes that there is a 30% chance of the first outcome and a 70% chance of the second outcome. The trader calculates the call prices for three month options using 10% and 40% volatility. Then using the weighted average price from the two prices), the trader creates the implied volatilities The output table is in the following: A B D Strike price Call Price Call Price (calculated with 10% (calculated with 40% Vol) Vol) 24 26 28 6.519 4.358 2.341 0.867 0.195 0.025 0.002 30 Implied Volatility of the Weighted Average Price (of Columns A and B) 25.53 23.13 20.77 19.80 20.68 22.67 24.67 6.943 5.224 3.765 2.598 1.716 1.087 0.661 32 34 36 0) Discuss the characteristics of the options markets from the output table. [25 marks] (6) If the trader were to calculate the above table for three-month put options instead of call options, how will the results compare to the above output table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts