Question: need helo solving for consolidated COGS, inventory, and depreciation expense. In 2011. P acquired 90% of S. The acquisition resulted in $7 excess amortization expense

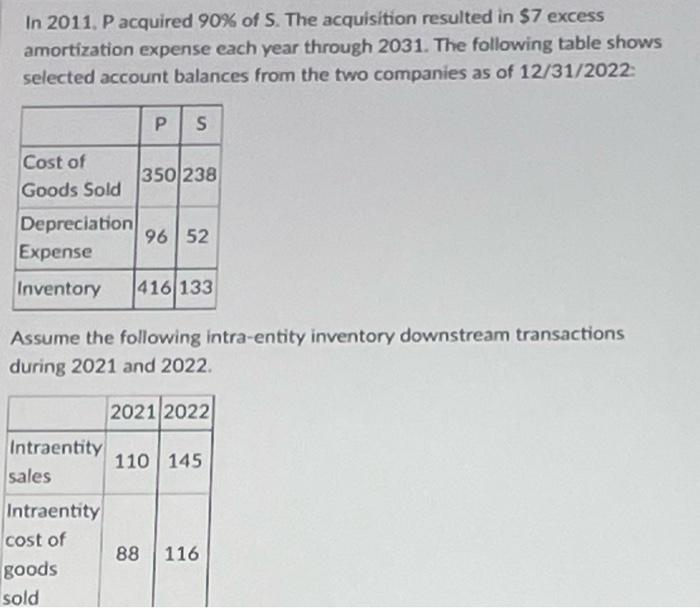

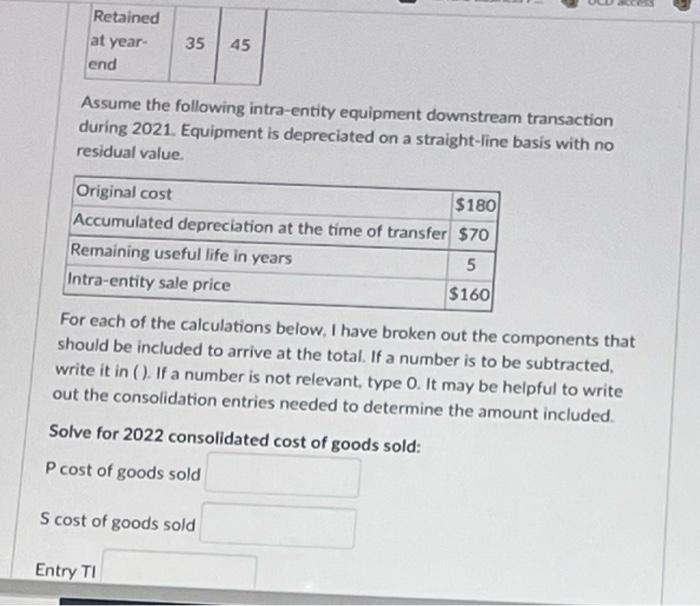

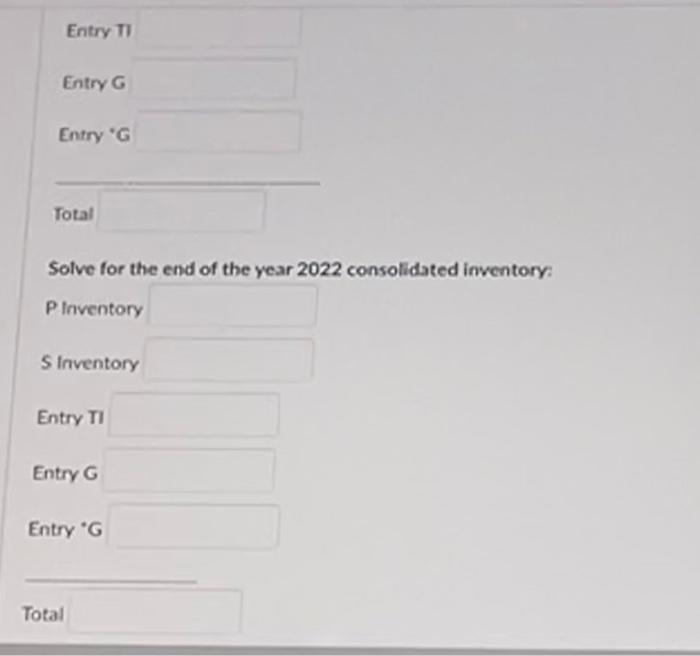

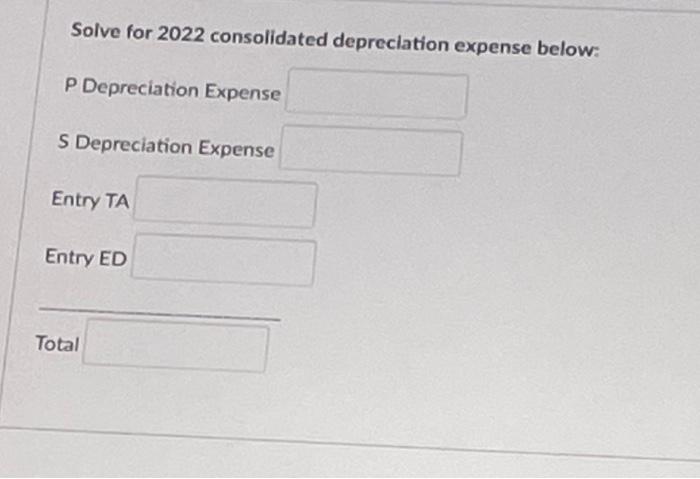

In 2011. P acquired 90% of S. The acquisition resulted in $7 excess amortization expense each year through 2031. The following table shows selected account balances from the two companies as of 12/31/2022: Assume the following intra-entity inventory downstream transactions during 2021 and 2022 . Assume the following intra-entity equipment downstream transaction during 2021. Equipment is depreciated on a straight-line basis with no residual value. ror each of the calculations below, I have broken out the components that should be included to arrive at the total. If a number is to be subtracted, write it in (). If a number is not relevant, type 0 . It may be helpful to write out the consolidation entries needed to determine the amount included. Solve for 2022 consolidated cost of goods sold: P cost of goods sold S cost of goods sold Entry TI Entry G Entry G Total Solve for the end of the year 2022 consolidated inventory: P inventory 5 Inventory Entry TI Entry G Entry G Solve for 2022 consolidated depreclation expense below: P Depreciation Expense S Depreciation Expense Entry TA Entry ED Total In 2011. P acquired 90% of S. The acquisition resulted in $7 excess amortization expense each year through 2031. The following table shows selected account balances from the two companies as of 12/31/2022: Assume the following intra-entity inventory downstream transactions during 2021 and 2022 . Assume the following intra-entity equipment downstream transaction during 2021. Equipment is depreciated on a straight-line basis with no residual value. ror each of the calculations below, I have broken out the components that should be included to arrive at the total. If a number is to be subtracted, write it in (). If a number is not relevant, type 0 . It may be helpful to write out the consolidation entries needed to determine the amount included. Solve for 2022 consolidated cost of goods sold: P cost of goods sold S cost of goods sold Entry TI Entry G Entry G Total Solve for the end of the year 2022 consolidated inventory: P inventory 5 Inventory Entry TI Entry G Entry G Solve for 2022 consolidated depreclation expense below: P Depreciation Expense S Depreciation Expense Entry TA Entry ED Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts