Question: NEED HELP 2. A developer is planning an outlet shopping center. At the project appraisal stage, two contract methods are under consideration: (1). Design-building (DB)

NEED HELP

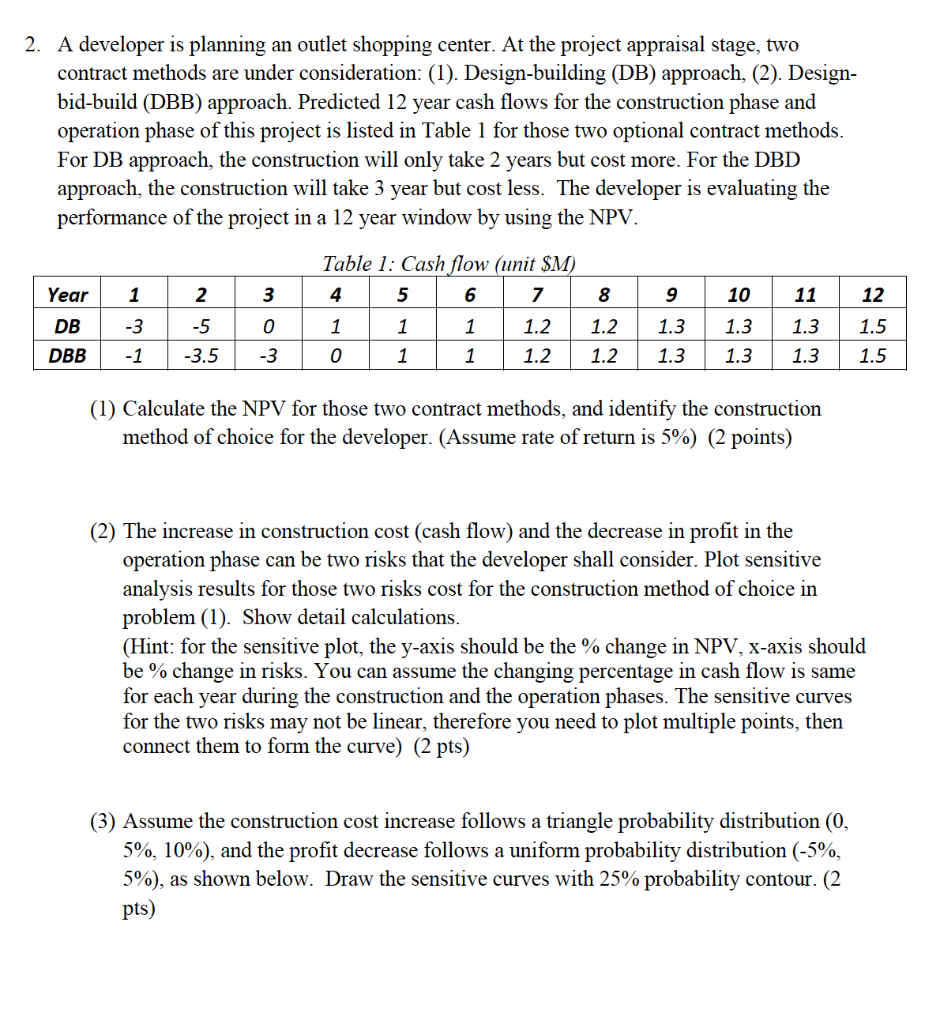

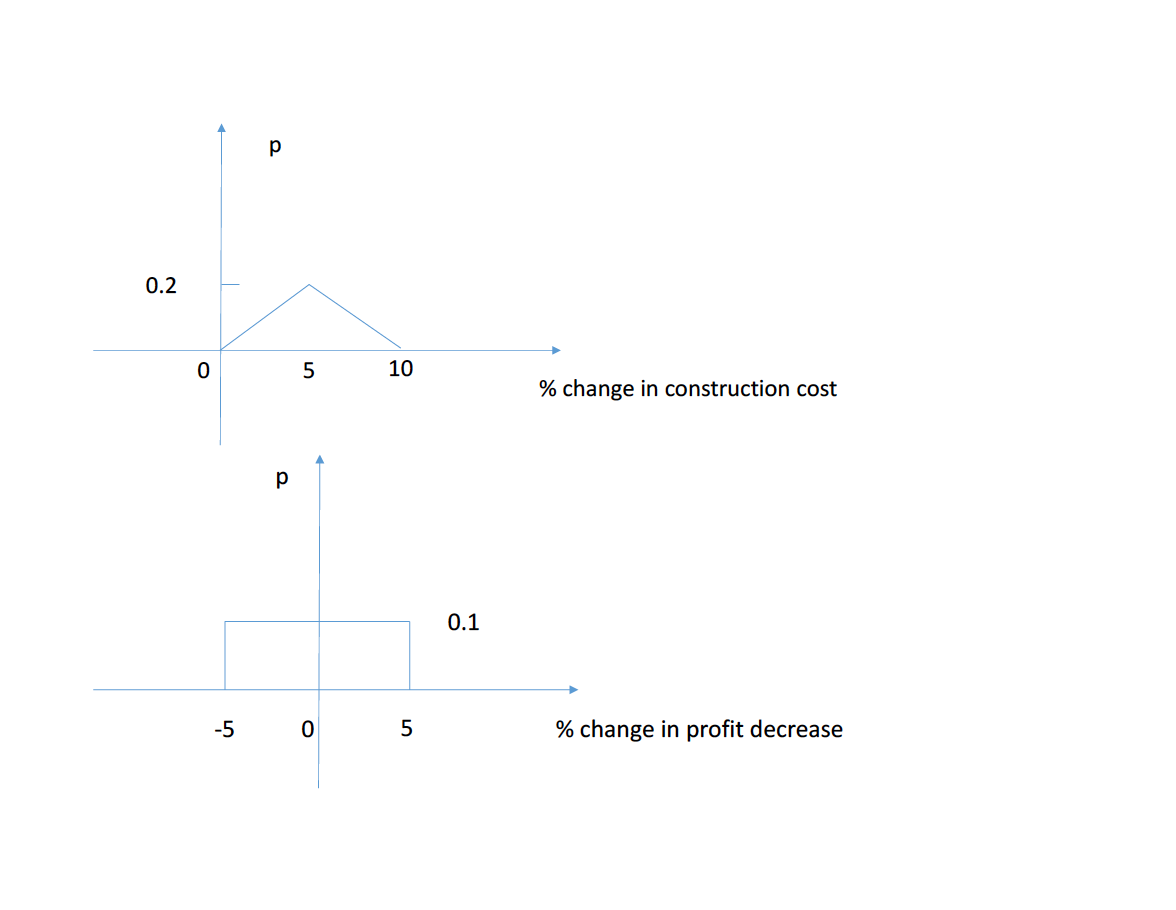

2. A developer is planning an outlet shopping center. At the project appraisal stage, two contract methods are under consideration: (1). Design-building (DB) approach, (2). Design- bid-build (DBB) approach. Predicted 12 year cash flows for the construction phase and operation phase of this project is listed in Table 1 for those two optional contract methods. For DB approach, the construction will only take 2 years but cost more. For the DBD approach, the construction will take 3 year but cost less. The developer is evaluating the performance of the project in a 12 year window by using the NPV. Table 1: Cash flow (unit $M) 4 5 6 7 Year 1 2 3 8 9 10 11 12 DB -3 -5 0 1 1.2 1.2 1.3 1.3 1.5 1 0 1 1 1.3 1.3 DBB -1 -3.5 -3 1 1.2 1.2 1.3 1.3 1.5 (1) Calculate the NPV for those two contract methods, and identify the construction method of choice for the developer. (Assume rate of return is 5%) (2 points) (2) The increase in construction cost (cash flow) and the decrease in profit in the operation phase can be two risks that the developer shall consider. Plot sensitive analysis results for those two risks cost for the construction method of choice in problem (1). Show detail calculations. (Hint: for the sensitive plot, the y-axis should be the % change in NPV, x-axis should be % change in risks. You can assume the changing percentage in cash flow is same for each year during the construction and the operation phases. The sensitive curves for the two risks may not be linear, therefore you need to plot multiple points, then connect them to form the curve) (2 pts) (3) Assume the construction cost increase follows a triangle probability distribution (0, 5%, 10%), and the profit decrease follows a uniform probability distribution (-5%, 5%), as shown below. Draw the sensitive curves with 25% probability contour. (2 pts) p 0.2 0 5 10 % change in construction cost p 0.1 -5 0 5 % change in profit decrease 2. A developer is planning an outlet shopping center. At the project appraisal stage, two contract methods are under consideration: (1). Design-building (DB) approach, (2). Design- bid-build (DBB) approach. Predicted 12 year cash flows for the construction phase and operation phase of this project is listed in Table 1 for those two optional contract methods. For DB approach, the construction will only take 2 years but cost more. For the DBD approach, the construction will take 3 year but cost less. The developer is evaluating the performance of the project in a 12 year window by using the NPV. Table 1: Cash flow (unit $M) 4 5 6 7 Year 1 2 3 8 9 10 11 12 DB -3 -5 0 1 1.2 1.2 1.3 1.3 1.5 1 0 1 1 1.3 1.3 DBB -1 -3.5 -3 1 1.2 1.2 1.3 1.3 1.5 (1) Calculate the NPV for those two contract methods, and identify the construction method of choice for the developer. (Assume rate of return is 5%) (2 points) (2) The increase in construction cost (cash flow) and the decrease in profit in the operation phase can be two risks that the developer shall consider. Plot sensitive analysis results for those two risks cost for the construction method of choice in problem (1). Show detail calculations. (Hint: for the sensitive plot, the y-axis should be the % change in NPV, x-axis should be % change in risks. You can assume the changing percentage in cash flow is same for each year during the construction and the operation phases. The sensitive curves for the two risks may not be linear, therefore you need to plot multiple points, then connect them to form the curve) (2 pts) (3) Assume the construction cost increase follows a triangle probability distribution (0, 5%, 10%), and the profit decrease follows a uniform probability distribution (-5%, 5%), as shown below. Draw the sensitive curves with 25% probability contour. (2 pts) p 0.2 0 5 10 % change in construction cost p 0.1 -5 0 5 % change in profit decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts