Question: need help !!! 26. The best method, under all circumstances, for making capital budgeting decisions is the: A. payback period. B. net present value. C.

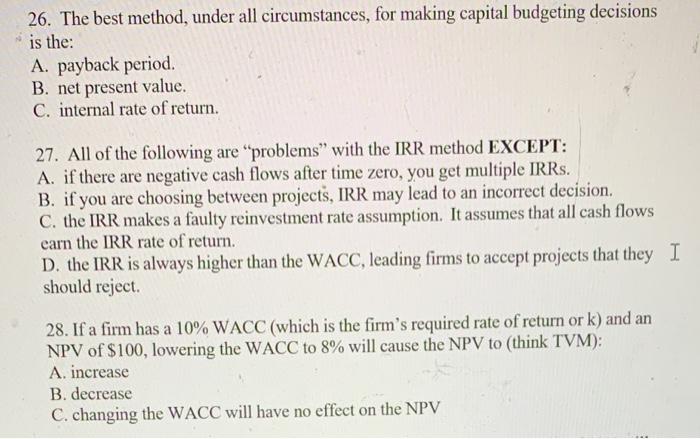

26. The best method, under all circumstances, for making capital budgeting decisions is the: A. payback period. B. net present value. C. internal rate of return. 27. All of the following are "problems with the IRR method EXCEPT: A. if there are negative cash flows after time zero, you get multiple IRRs. B. if you are choosing between projects, IRR may lead to an incorrect decision. C. the IRR makes a faulty reinvestment rate assumption. It assumes that all cash flows earn the IRR rate of return. D. the IRR is always higher than the WACC, leading firms to accept projects that they I should reject. 28. If a firm has a 10% WACC (which is the firm's required rate of return or k) and an NPV of $100, lowering the WACC to 8% will cause the NPV to (think TVM): A. increase B. decrease C. changing the WACC will have no effect on the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts