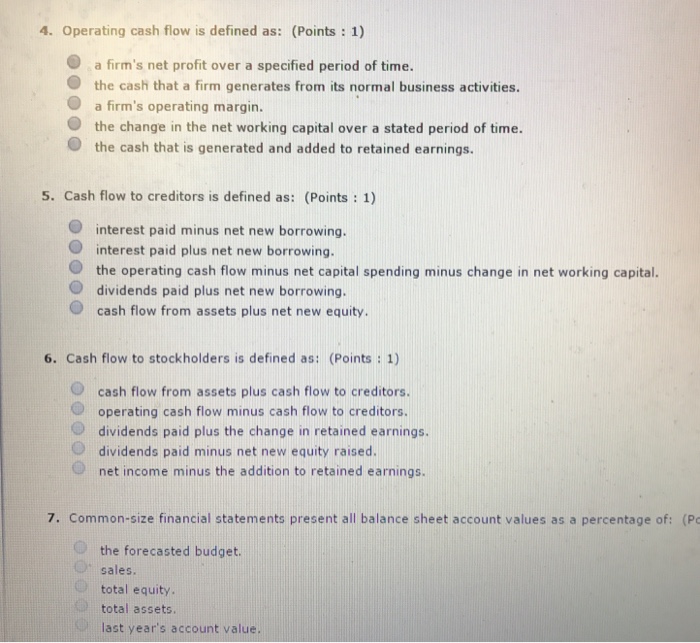

Question: Need help 4-7 Operating cash flow is defined as: a firm's net profit over a specified period of time. the cash that a firm generates

Operating cash flow is defined as: a firm's net profit over a specified period of time. the cash that a firm generates from its normal business activities. a firm's operating margin. the change in the net working capital over a stated period of time. the cash that is generated and added to retained earnings. Cash flow to creditors is defined as: interest paid minus net new borrowing. interest paid plus net new borrowing. the operating cash flow minus net capital spending minus change in net working capital. dividends paid plus net new borrowing. cash flow from assets plus net new equity. Cash flow to stockholders is defined as: cash flow from assets plus cash flow to creditors. operating cash flow minus cash flow to creditors. dividends paid plus the change in retained earnings. dividends paid minus net new equity raised. net income minus the addition to retained earnings. Common-size financial statements present all balance sheet account values as a percenta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts