Question: need help; all pictures are for one question 1. Borrowed $102,600 from the bank to start the business, 2. Provided $68,400 of services to clients

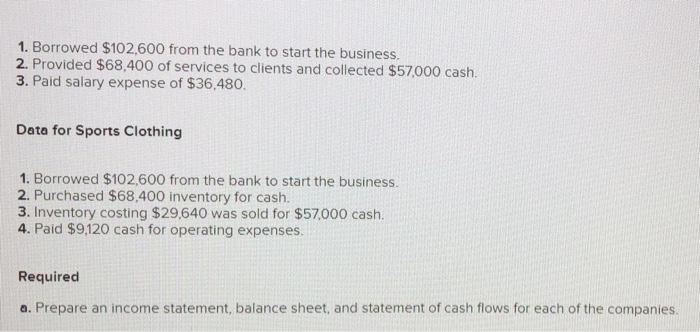

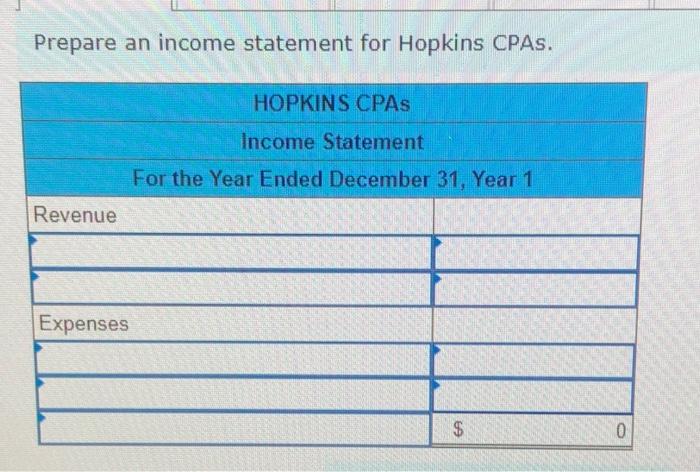

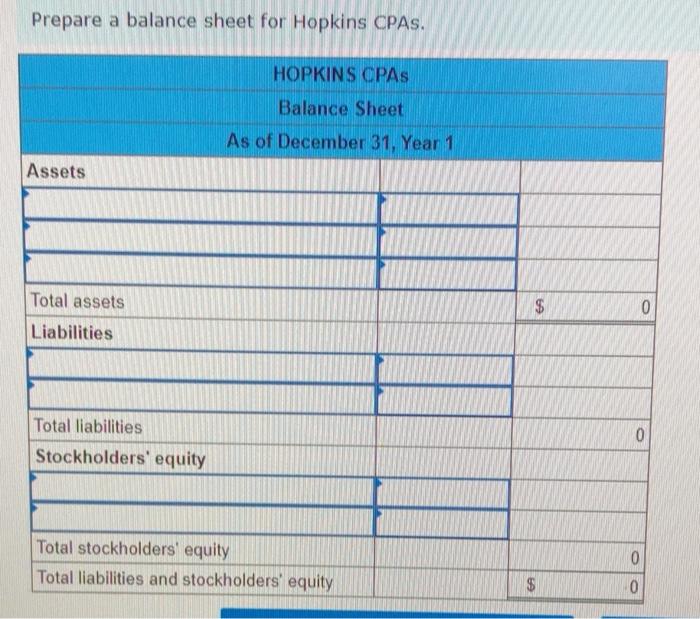

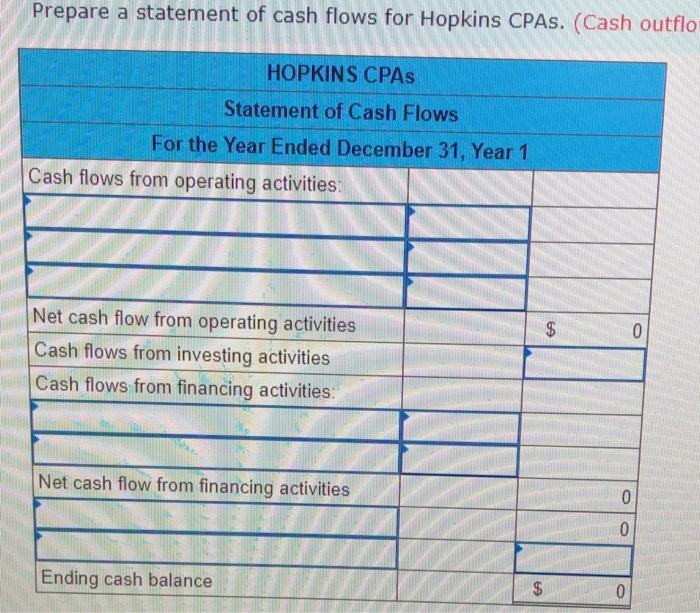

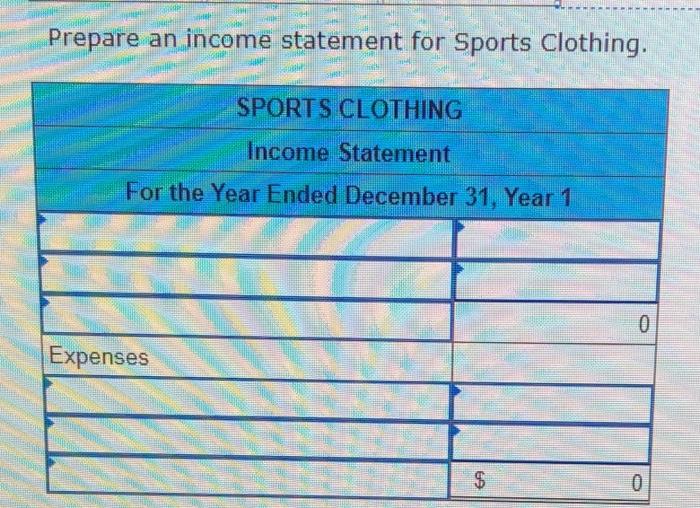

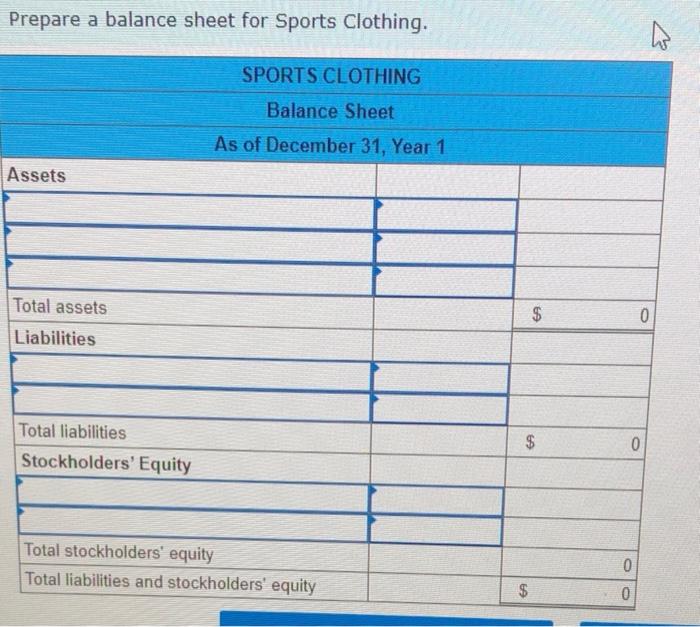

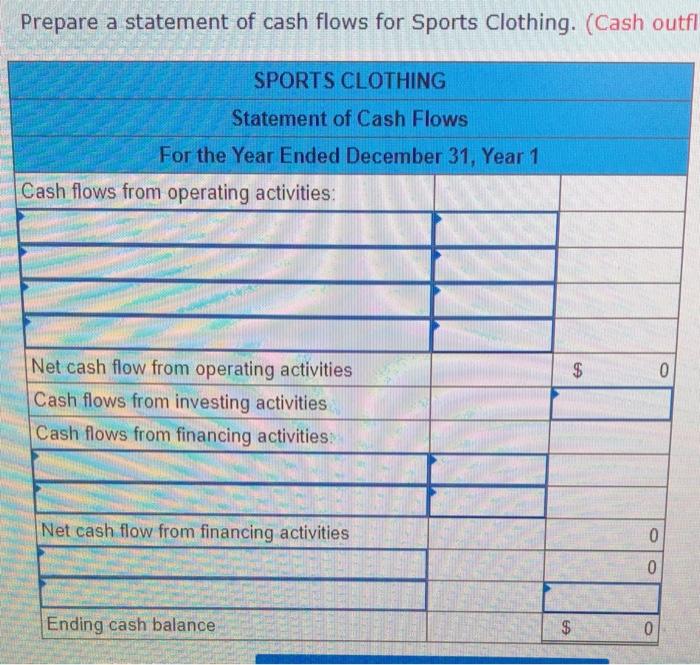

1. Borrowed $102,600 from the bank to start the business, 2. Provided $68,400 of services to clients and collected $57,000 cash. 3. Paid salary expense of $36.480. Data for Sports Clothing 1. Borrowed $102,600 from the bank to start the business. 2. Purchased $68,400 inventory for cash. 3. Inventory costing $29,640 was sold for $57,000 cash. 4. Paid $9,120 cash for operating expenses. Required a. Prepare an income statement, balance sheet, and statement of cash flows for each of the companies. Prepare an income statement for Hopkins CPAs. HOPKINS CPAS Income Statement For the Year Ended December 31, Year 1 Revenue Expenses GA $ 0 Prepare a balance sheet for Hopkins CPAs. HOPKINS CPAS Balance Sheet As of December 31, Year 1 Assets Total assets $ 0 Liabilities Total liabilities Stockholders' equity 0 Total stockholders' equity Total liabilities and stockholders' equity 0 $ 0 Prepare a statement of cash flows for Hopkins CPAs. (Cash outflo HOPKINS CPAS Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flows from operating activities: $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net cash flow from financing activities 0 0 Ending cash balance $ 6A Prepare an income statement for Sports Clothing. SPORTS CLOTHING Income Statement For the Year Ended December 31, Year 1 0 Expenses $ Prepare a balance sheet for Sports Clothing. SPORTS CLOTHING Balance Sheet As of December 31, Year 1 Assets Total assets $ 0 Liabilities Total liabilities Stockholders' Equity $ 0 Total stockholders' equity Total liabilities and stockholders' equity 0 $ 0 Prepare a statement of cash flows for Sports Clothing. (Cash outfl SPORTS CLOTHING Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flows from operating activities: $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities: Net cash flow from financing activities 0 0 Ending cash balance EA $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts