Question: Need help analyzing these financial ratios. For each ratio, what assumptions can you make regarding this company? The company in question is a retail clothing

Need help analyzing these financial ratios. For each ratio, what assumptions can you make regarding this company? The company in question is a retail clothing company

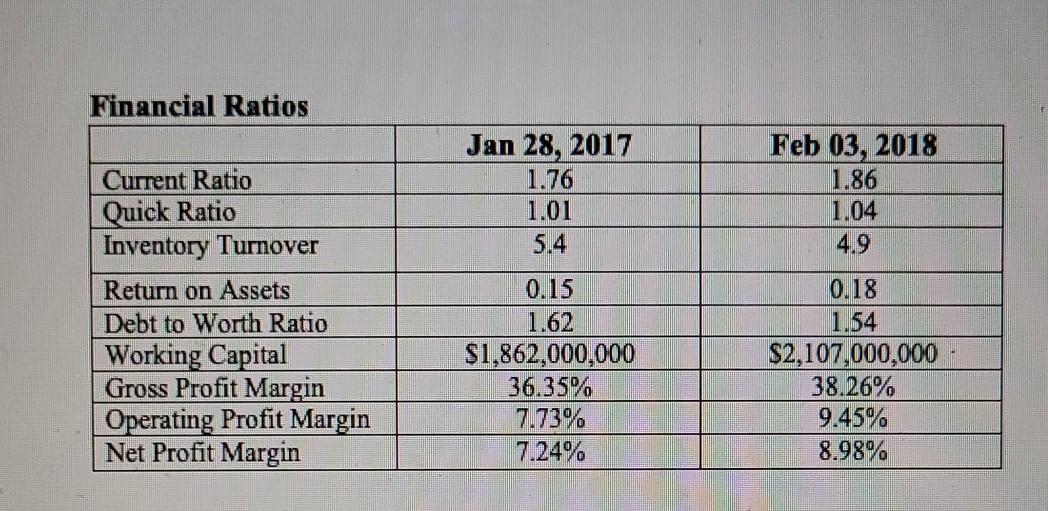

Financial Ratios Jan 28, 2017 1.76 1.01 5.4 Feb 03, 2018 1.86 1.04 4.9 Current Ratio Quick Ratio Inventory Turnover Return on Assets Debt to Worth Ratio Working Capital Gross Profit Margin Operating Profit Margin Net Profit Margin 0.15 1.62 $1,862,000,000 36.35% 7.73% 7.24% 0.18 1.54 $2,107,000,000 38.26% 9.45% 8.98%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock