Question: Need help answering 12-16 thank you The variable expense per unit is $12 and the selling price per unit is $40. Then the contribution margin

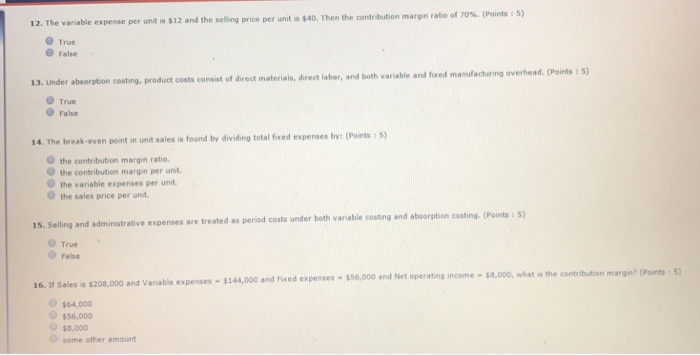

The variable expense per unit is $12 and the selling price per unit is $40. Then the contribution margin ratio of 70%. True False Under absorption costing, product costs consist of direct materials, direct labor, and both variable and fixed manufacturing overhead. True False The break-even point in unit sales is found by dividing total fixed expenses by: the contribution margin ratio. the contribution margin per unit. the variable expenses per unit. the sales price per unit. Selling and administrative expenses are treated as period costs under both variable costing and absorption costing. True False If sales is $208,000 and variable expenses = $14,000 and Fixed expenses = $56,000 and Net operating income = $8,000, what is the contribution margin? $64,000 $56,000 $8.000 some other amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts