Question: need help answering part 2 (1) What is the yield to maturity on a 10 -year, 9% annual coupon, $1,000 par value bond that sells

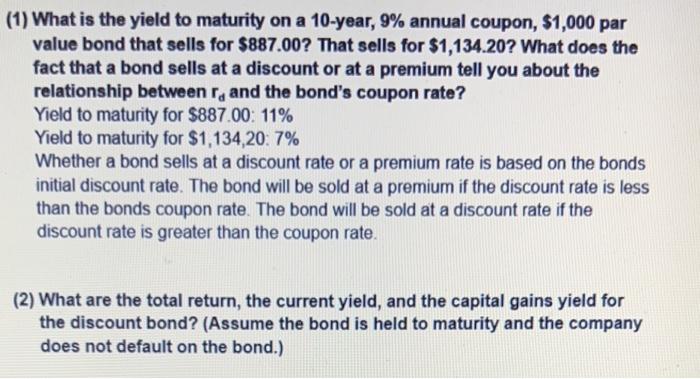

(1) What is the yield to maturity on a 10 -year, 9% annual coupon, $1,000 par value bond that sells for $887.00 ? That sells for $1,134.20 ? What does the fact that a bond sells at a discount or at a premium tell you about the relationship between rd and the bond's coupon rate? Yield to maturity for $887.00:11% Yield to maturity for $1,134,20:7% Whether a bond sells at a discount rate or a premium rate is based on the bonds initial discount rate. The bond will be sold at a premium if the discount rate is less than the bonds coupon rate. The bond will be sold at a discount rate if the discount rate is greater than the coupon rate. (2) What are the total return, the current yield, and the capital gains yield for the discount bond? (Assume the bond is held to maturity and the company does not default on the bond.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts