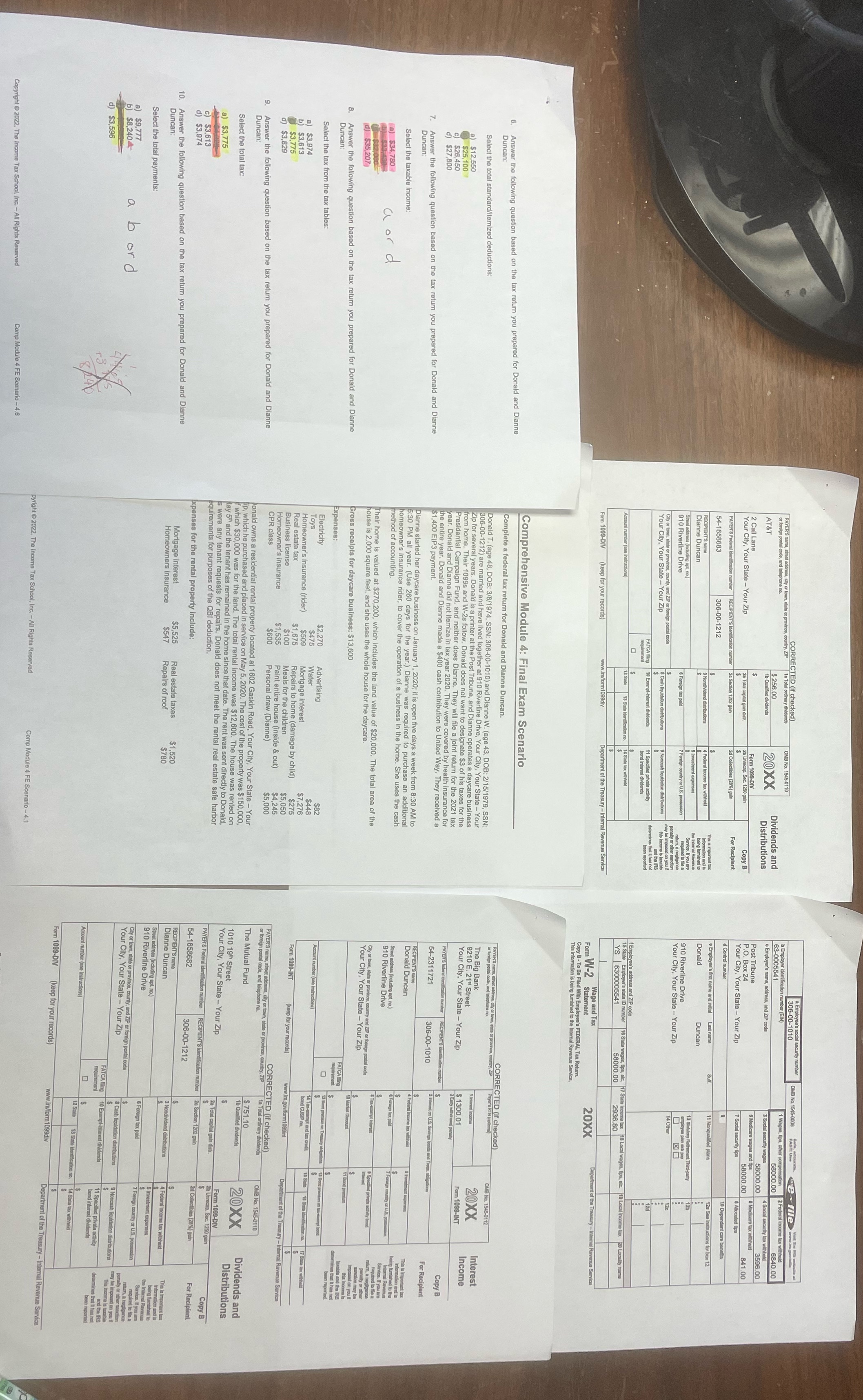

Question: Need help answering questions 7 and 10. Exampleree's not security number OMB No. 1545-0008 Aside. file CORRECTED (if checked PAYER'S name- today as man city

Need help answering questions 7 and 10.

Exampleree's not security number OMB No. 1545-0008 Aside. file CORRECTED (if checked PAYER'S name- today as man city or town, cia OMB No. 1545-0110 b Employer Identis number (EIN) 1 Wages, lips, other $6060.00 2 Federal Income tax withheld Dividends and 63-0005541 AT&T 256.00 20XX Distributions c Employer's name, address, and ZIP code 3 Social security 58000.00 cial security tax withheld 2 Call Lane Form 1099-DIV Post Tribune 5 Medicare wages and "0 Medicare lax withhold 841.00 Your City, Your State - Your Zip 20 Unrecap. Sec. 1250 gain Copy B Your City, Your State - Your Zip Allocated lips PAYER'S Federal number RECIPIENT'S Kenfication num 2c Section 1202 gain or Recipient d Control number 0 Dependent care benefits 54-1658683 306-00-1212 . Employee's first name and initial Last name iled plans 12a See instructions for box 12 RECIPIENT'S name 4 Federal income tax withhel Donald Duncan Dianne Duncan to Internal Re 13 Statutory Reframe 910 Riverline Drive 910 Riverline Drive Foreign tax pald penalty or other sanction Your City, Your State - Your Zip 14 OFF A....A........ state of province, county, and ZIP or foreign postal a Your City, Your State - Your Zip Cash liqu Noncash Bquidation distributions and the IRS FATCA Sing 10 Exert 4-interest dividends 11 Specified private activity D Account number (coo instructions) 12 Stein 13 State Ker 14 Simile lax withold I Employee's address and ZIP code 58000.00 byer's state ID number 16 State wages, lips, etc. 17 Still income tax 18 Local wages, lips, etc. 10 Local Income tax 20 Locality name YS | 6300005541 Form 1099-DIV (keep for your records) www.ira/form1099div Department of the Treasury - Internal Revenue Service Form W-2 Wage and Tax 20XX Treasury - Internal Revenue Service Statement Copy B - To Be Filled With Employee's FEDERAL Tax Return. Comprehensive Module 4: Final Exam Scenario 6. Answer the following question based on the tax return you prepared for Donald and Dianne Duncan: Complete a federal tax return for Donald and Dianne Duncan. CORRECTED (if checked) ove No. 1545-0112 Select the total standard/itemized deductions: Donald T. (age 48, DOB: 3/8/1974, SSN: 306-00-1010) and Dianne W. (age 43, DOB: 2/15/1979, SSN: 306-00-1212) ed and have lived together at 910 Riverline Drive, Your City, Your State - Your The Big Bank 9210 E. 21 " Street 20XX Interest $12,550 home. Their 1099s and whoprinter at the Post Tribune, and Dianne operates a daycare business Your City, Your State - Your Zip $ 1300.01 ormn 1099-INT Income $25,100 Presidential Campaign Fund, and neither does Dianne. They will file a joint return for the 2021 tax $27,800 year. Donald and Dianne did not itemize in tax year 2020. They were covered by health Insurance for PAYER'S loderal Idand cation Buttiber RECENT'S Bar Copy B the entire year. Donald and Dianne made a $400 cash contribution to United Way. They received a 7. Answer the following question based on the tax return you prepared for Donald and Dianne 1,400 EIP3 payment. 54-2311721 806-00-1010 For Recipient Duncan: Dianne started her daycare business on January 1, 2020; it is open five days a week from 8:30 RECPENT'S name Select the taxable income 5:30 PM all year. (Use 260 days for the year.) Dianne was required to purchase an additional Donald Duncan This Its Important tax homeowner's insurance rider, to cover the operation of a business in the purchase an method of accounting. Street address Including apt no . ) a) $34,780 a or d 910 Riverline Drive Their home is valued at $270,200, which Includes the land value of $20,000. The total area of the Caly or town, state or province, cour d) $35 207 house is 2,000 square feet, and she uses the whole house for the daycare. Your City, Your State - Your Zip 8. Answer the following question based on the tax return you prepared for Donald and Dianne Gross receipts for daycare business: $13,600 FATCA ing Duncan: Expenses: Select the tax from the tax tables : Electricity Advertising $82 Toys $475 water $448 B) $3,974 Homeowner's insurance (rider) $509 Mortgage interest $7.276 b) $3,613 Real estate tax to home (dam $275 Form 1099-INT (keep for your rec $3,775 Business license ant of the Treasury - Internal) Homeowner's insurance $1.535 Meals for the children $5.050 mal Revenue Service d) $3.829 Paint entire house (inside SA 245 CPR class $600 9. Answer the following question based on the tax return you prepared for Donald and Dianne Personal draw (Dianne) $5,000 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP a To code, and telephone no. ordinary dividends OMB No. 1545-0110 Duncan: onald owns a residential rental property located at 1602 Gaskin Road, Your City, Your State - Your The Mutual Fund $ 751.10 ip, which he purchased and placed in service on on May 5, 2020. The cost of the property was $150,000, 10 Quair 20XX Dividends and Select the total tax: $30,000 was for the land. The total rental income was $12,600. The house was rented on 1010 19th Street Distributions hay 5" and the tenant has remained in the home since that date. The rent was sent directly to Donald, a) $3,775 s were any tenant requests for repairs. Donald does not meet the rental real estate safe harbor Your City, Your State - Your Zip 20 Total capital gain distr Form 1099-DIV equirements for purposes of the QBI deduction. PAYER'S Federal d C) $3.613 RECIPIENT'S Identification ru Copy B 20 Section 1202 gain $3,974

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts