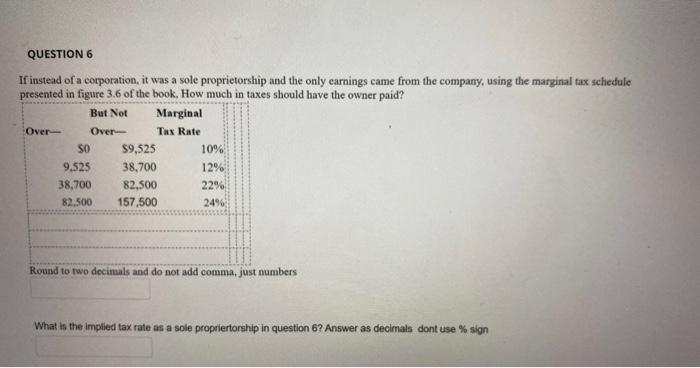

Question: Need help answering this question with the date from the picture. QUESTION 6 A) If instead of a corporation, it was a sole proprietorship and

QUESTION 6 If instead of a corporation, it was a sole proprietorship and the only earnings came from the company, using the marginal tax schedule presented in figure 3.6 of the book. How much in taxes should have the owner paid? But Not Marginal Over Tax Rate SO $9.525 10% 9.525 38,700 12% 38,700 82,500 22% 82.500 157,500 24% Over Round to two decimals and do not add comma, just numbers What is the implied tax rate as a sole proprietorship in question 6? Answer as decimals dont use % sign QUESTION 6 If instead of a corporation, it was a sole proprietorship and the only earnings came from the company, using the marginal tax schedule presented in figure 3.6 of the book. How much in taxes should have the owner paid? But Not Marginal Over Tax Rate SO $9.525 10% 9.525 38,700 12% 38,700 82,500 22% 82.500 157,500 24% Over Round to two decimals and do not add comma, just numbers What is the implied tax rate as a sole proprietorship in question 6? Answer as decimals dont use % sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts