Question: Need Help asap A contract is estimated to yield net annual returns of $24,000 for nine years. To secure the contract, an immediate outlay of

Need Help asap

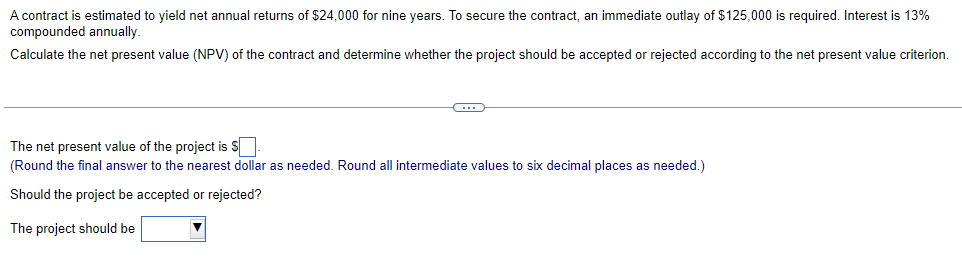

A contract is estimated to yield net annual returns of $24,000 for nine years. To secure the contract, an immediate outlay of $125,000 is required. Interest is 13% compounded annually Calculate the net present value (NPV) of the contract and determine whether the project should be accepted or rejected according to the net present value criterion. (.. The net present value of the project is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) Should the project be accepted or rejected? The project should be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock