Question: need help asap BACT10S Business Accounting. Tutorial Homework for Week 4 (based on lecture Week 2,3 & 4). This will be considered as a part

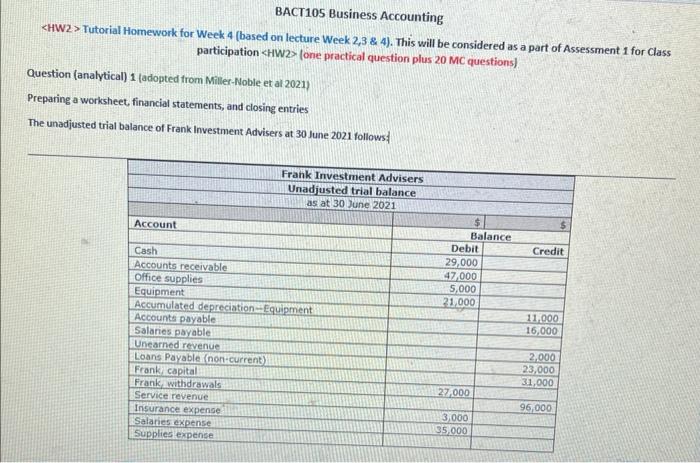

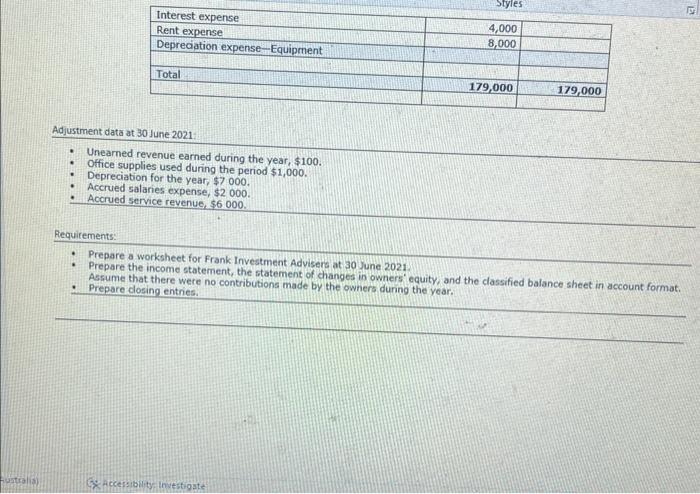

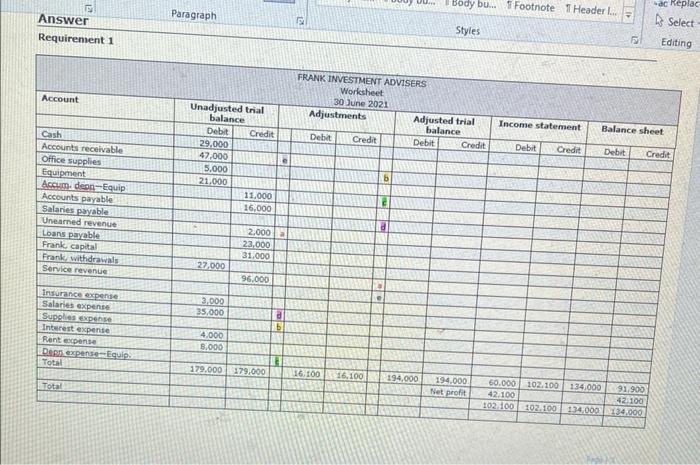

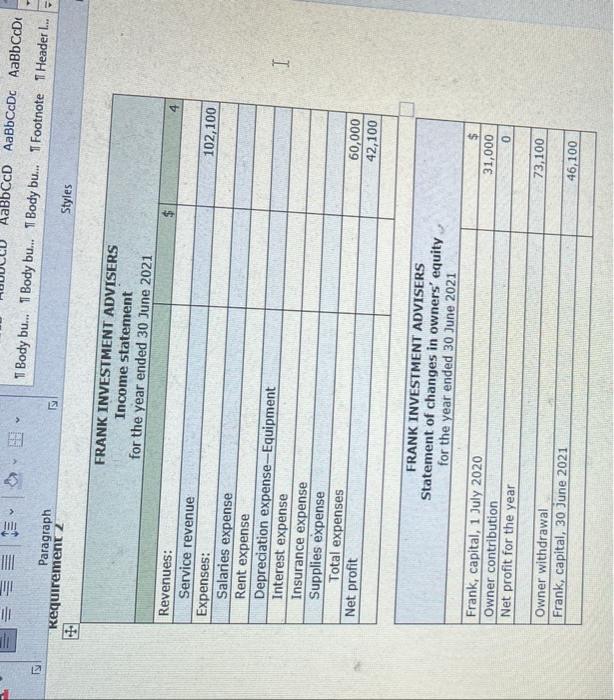

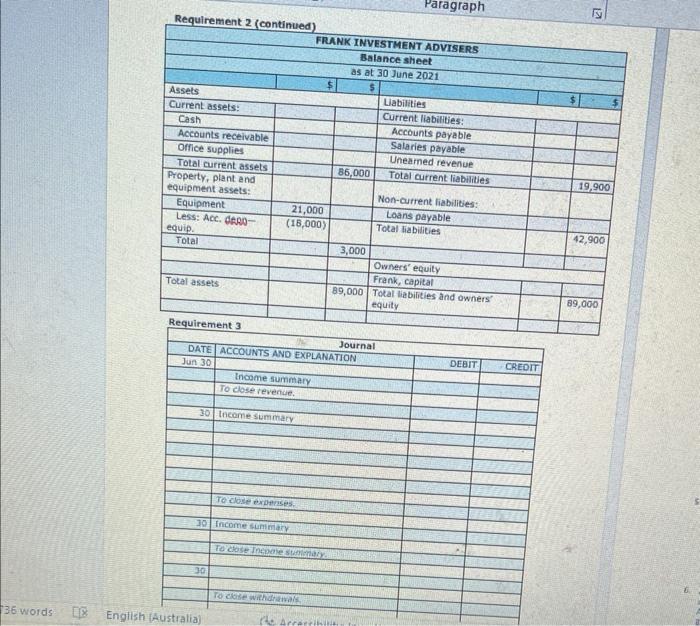

BACT10S Business Accounting. Tutorial Homework for Week 4 (based on lecture Week 2,3 \& 4). This will be considered as a part of Assessment 1 for Class participation HW2> (one practical question plus 20MC questions). Question (analytical) 1 (adopted from Miller-Noble et al 2021) Preparing a worksheet, financial statements, and closing entries The unadjusted trial balance of Frank Investment Advisers at 30 June 2021 follows:. Requirements: - Prepare a worksheet for Frank Irvestment Advisera at 30 June 2021. - Prepare the income statement, the statement of changes in owners' equity, and the classified balance sheet in account format. Assume that there were no contributions made by the owners dunno the year. - Prepare closing entries. Requirensent 1 Requirement 2 (continuad)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts