Question: Need help ASAP!!! Calculate the internal rate of return (using Excel) for the following scenario: PPI, Inc. looking to purchase a new machine to aid

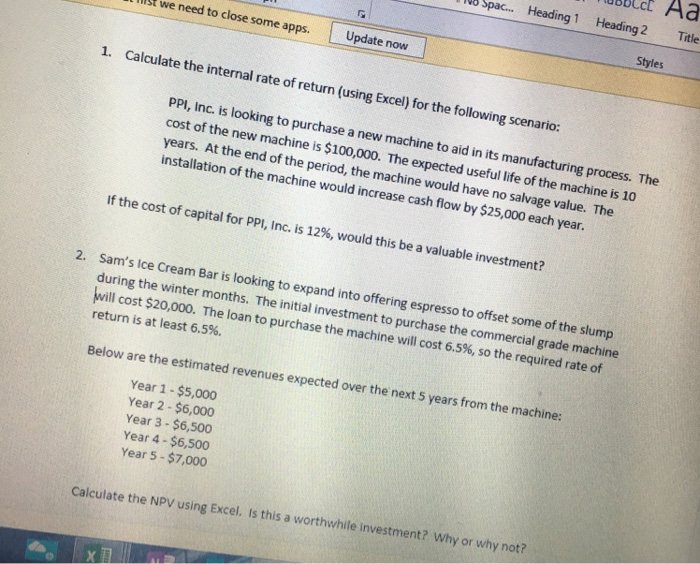

Calculate the internal rate of return (using Excel) for the following scenario: PPI, Inc. looking to purchase a new machine to aid in its is manufacturing process. The installation cost of the new machine is $100,000. The expected useful life of the machine is 10 years. At the end of the period, the machine would have no salvage value. The installation of the machine would increase cash flow by $25,000 each year. If the cost of capital for PPI, Inc. is 12%, would this be a valuable investment? Sam's cream Bar is to expand into offering espresso to offset some of the slump during the winter months. The initial investment to purchase the commercial grade machine will cost $20,000. The loan to purchase the machine will cost 6.5%, so the required rate of return is at least 6.5%. Below are the estimated revenues expected over the next 5 years from the machine: Year 1 - $5,000 Year 2 - $6,000 Year 3 - $6, 500 Year 4 - $6, 500 Year 5 - $7,000 Calculate the NPV using Excel. Is this a worthwhile investment? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts