Question: need help asap Help Save & Exit As the management accountant for the Tyson Company you have been asked to construct a financial planning model

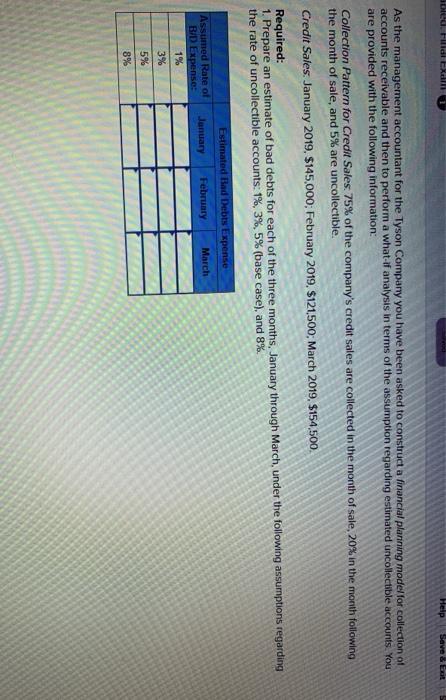

Help Save & Exit As the management accountant for the Tyson Company you have been asked to construct a financial planning model for collection of accounts receivable and then to perform a what If analysis in terms of the assumption regarding estimated uncollectible accounts You are provided with the following information: Collection Pattern for Credit Sales 75% of the company's credit sales are collected in the month of sale, 20% in the month following the month of sale, and 5% are uncollectible. Credit Sales January 2019, $145,000; February 2019, S121,500; March 2019, $154,500 Required: 1. Prepare an estimate of bad debts for each of the three months, January through March, under the following assumptions regarding the rate of uncollectible accounts: 1%, 3%.5% (base case), and 8% Estimated Bad Debts Expense March February January Assumed Rate of BID Expense: 1% 3% 5% 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts