Question: need help asap i need excel format with formula screenshots please A large profitable corporation bought a small jet plane for use by the firm's

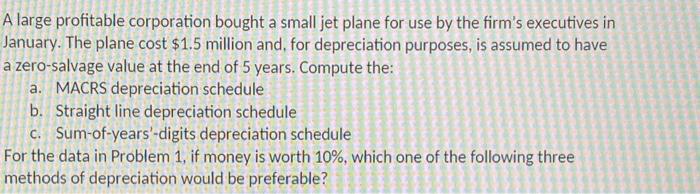

A large profitable corporation bought a small jet plane for use by the firm's executives in January. The plane cost $1.5 million and, for depreciation purposes, is assumed to have a zero-salvage value at the end of 5 years. Compute the: a. MACRS depreciation schedule b. Straight line depreciation schedule c. Sum-of-years'-digits depreciation schedule For the data in Problem 1, if money is worth 10%, which one of the following three methods of depreciation would be preferable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts