Question: Need help ASAP please. I do not understand. Talltree is considering a $12M Series B investment in Newco with the structure of 5M shares of

Need help ASAP please. I do not understand.

Need help ASAP please. I do not understand.

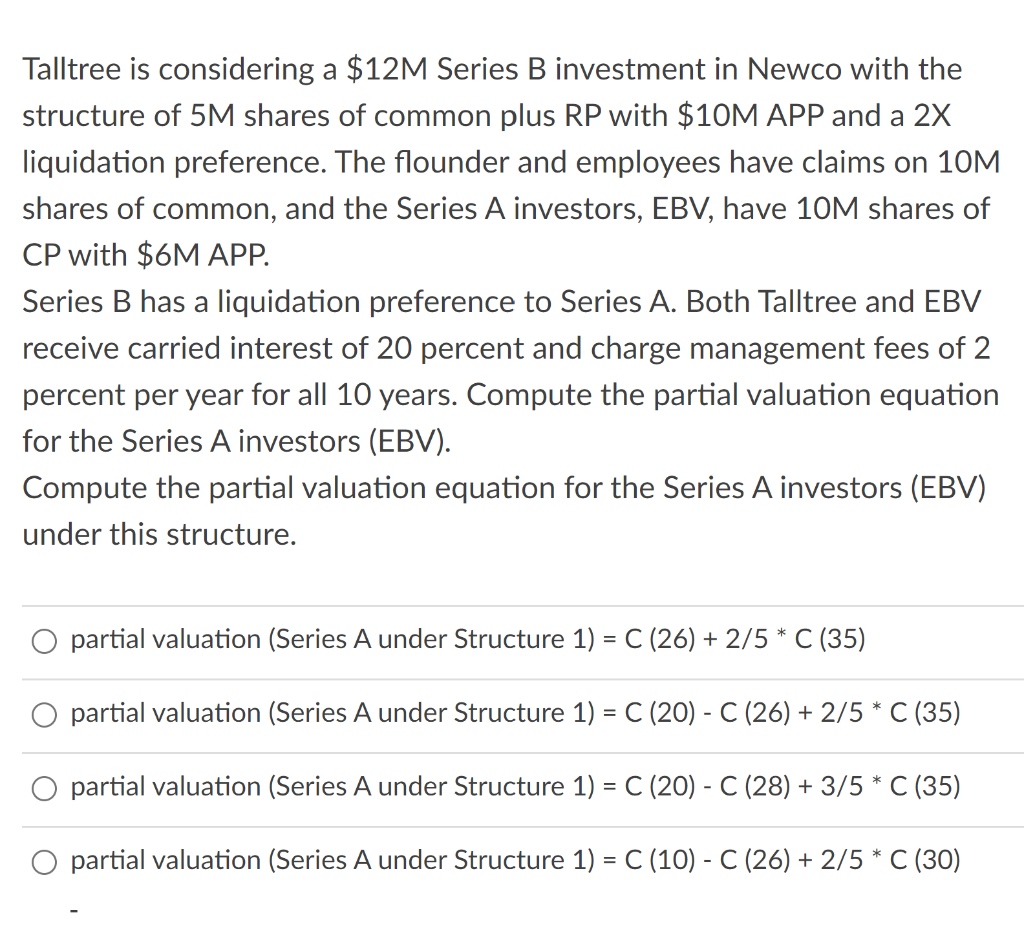

Talltree is considering a $12M Series B investment in Newco with the structure of 5M shares of common plus RP with $10M APP and a 2X liquidation preference. The flounder and employees have claims on 10M shares of common, and the Series A investors, EBV, have 10M shares of CP with $6M APP. Series B has a liquidation preference to Series A. Both Talltree and EBV receive carried interest of 20 percent and charge management fees of 2 percent per year for all 10 years. Compute the partial valuation equation for the Series A investors (EBV). Compute the partial valuation equation for the Series A investors (EBV) under this structure. O partial valuation (Series A under Structure 1) = C (26) + 2/5 * C (35) partial valuation (Series A under Structure 1) = C (20) - C (26) + 2/5 * C (35) O partial valuation (Series A under Structure 1) = C (20) - C (28) + 3/5 * C (35) partial valuation (Series A under Structure 1) = C (10) - C (26) + 2/5 * C (30)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts